Monster Expenses vs. Heroic Budgeting: An Anime Guide to Expense Control — Discover how to defeat financial monsters like impulse spending, subscriptions, and lifestyle inflation using anime-inspired budgeting strategies.

If your life were an anime, what kind of protagonist would you be?

Maybe you’re the underdog with hidden potential…

The strategist who learns from every defeat…

Or the hero trying to protect their village (your savings account) from invading monsters (your expenses).

In the real world, we don’t fight dragons, titans, or cosmic villains.

We fight something far sneakier:

Daily spending. Emotional purchases. Habits that drain our money quietly. Subscriptions that regenerate like Hydra’s heads. Impulse demons that whisper “Buy it now.”

This article is your ultimate guide to understanding and defeating the money monsters that attack your wallet — using simple, relatable, fun anime logic.

We’re going deep, we’re going detailed, and we’re staying efficient.

By the end, you’ll not only understand expense control —

You’ll feel empowered to master it like a true hero.

So cue the anime intro music…

Your budgeting arc begins now.

Chapter 1: Meet the Monsters — The Enemies Draining Your Wallet

Every great anime starts by introducing the villains.

And trust me — your financial villains are just as dramatic.

Let’s explore the five major types of expense monsters you encounter daily.

1. The Stealth Assassin Expenses — The Silent Wallet Killers

These are small, unnoticed purchases that collectively destroy your monthly budget.

They don’t roar. They whisper.

They don’t strike once. They stab you 50 times a month.

Examples:

- That $4 tea/coffee every day

- Random bakery snacks

- $5 online convenience fees

- UPI small charges

- Extra cheese on delivery orders

Individually, they seem harmless.

But add them up:

$4/day × 30 days = $120

$10/day × 30 days = $300

That’s real money — silently assassinated.

Hero Strategy:

Track every small purchase for one week.

You’ll be shocked at the number of stealth attacks happening daily.

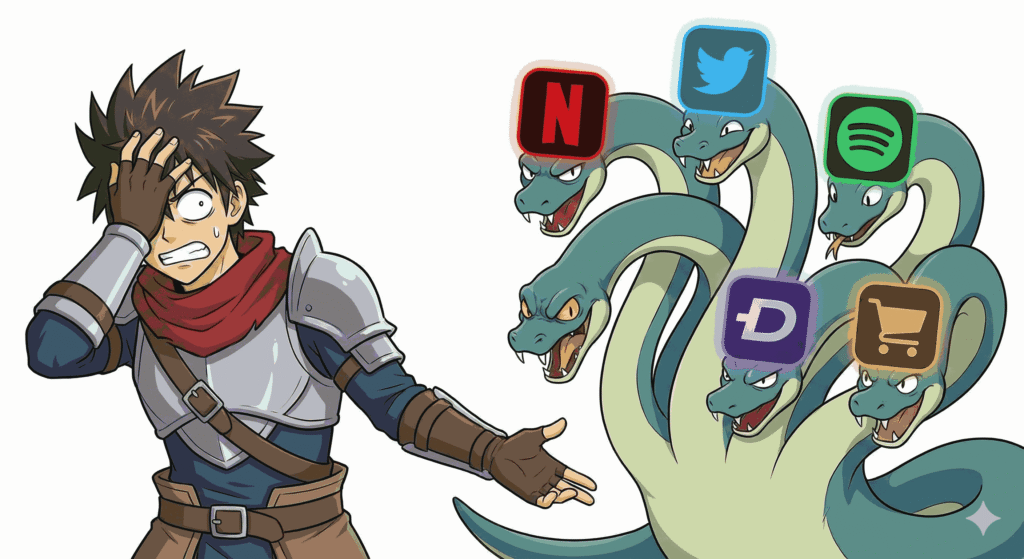

2. The Subscription Hydra — Cut One Head, Two More Grow

One of the deadliest monsters.

You start with a simple OTT subscription.

Then another.

Then a trial that accidentally renews.

Then, there is an app that needs a monthly fee.

Then cloud storage.

Then gym membership…

Before you realize it, you have 12 subscriptions, and use 3.

Why it’s dangerous:

Subscriptions are silent auto-debits.

You don’t feel the pain of paying.

Hero Strategy:

Make a “Subscription Scroll” listing:

- Name

- Monthly cost

- Next billing date

- Whether you actually use it

Cancel anything that doesn’t spark joy OR isn’t essential to your growth arc.

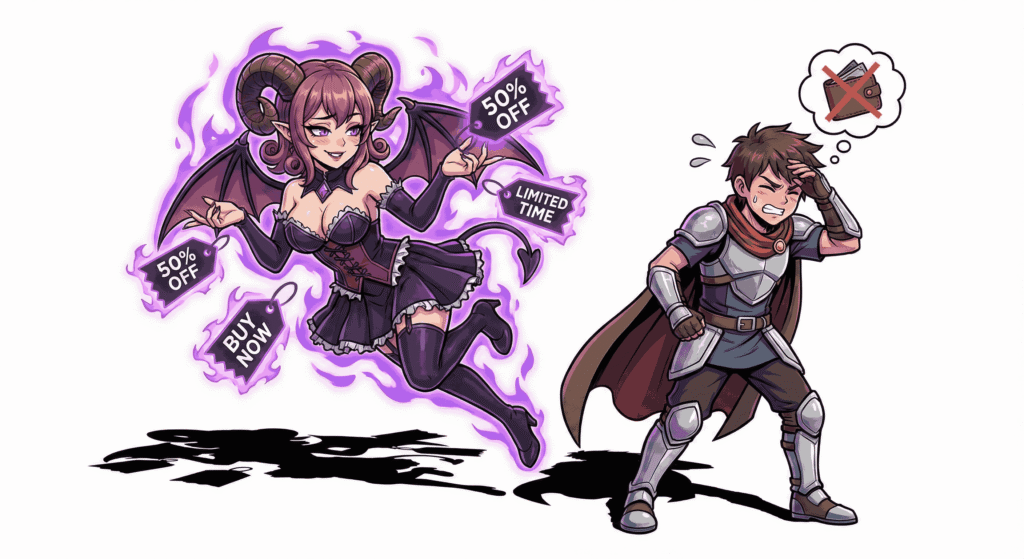

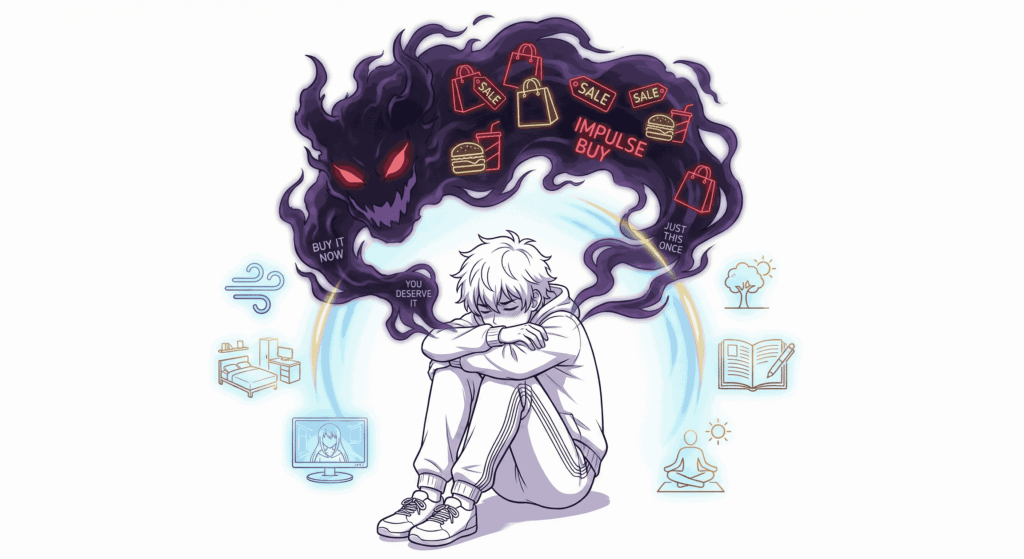

3. The Impulse Demon — The Most Popular Villain

This demon appears suddenly, usually disguised as:

- “Limited Time Only!”

- “Flash Sale!”

- “Deal ends in 2 hours!”

- “Only 1 item left!”

- “YOU saved $120!”

In anime terms, this is the villain who plays with your emotions.

It thrives on:

- Stress

- Boredom

- Happiness

- Loneliness

- Late-night scrolling

Impulse purchases feel good for 5 minutes.

Then regret enters the chat.

Hero Strategy:

Use the 3-Day Rule Jutsu:

If the item costs more than $50, wait 72 hours before buying.

Usually, the demon disappears on its own by then.

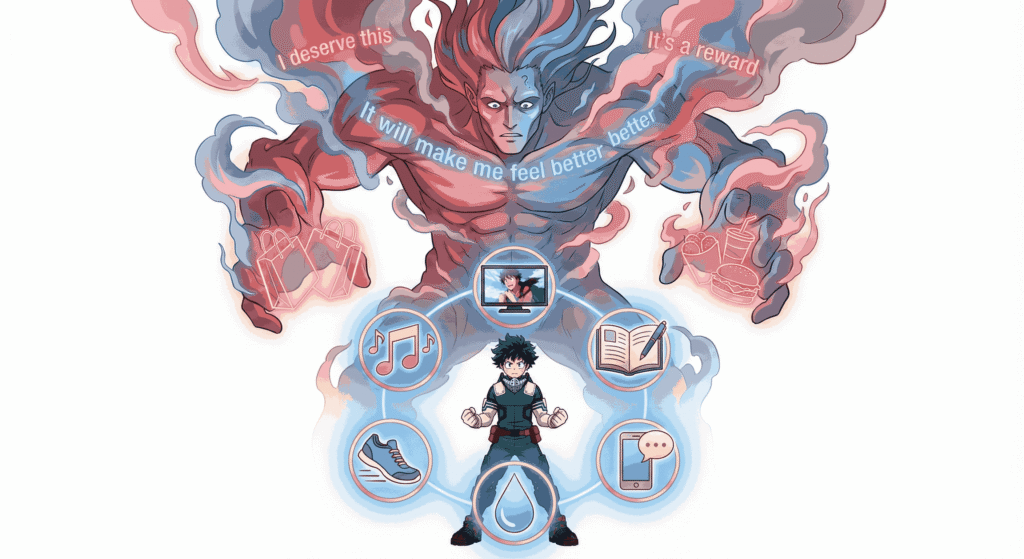

4. The Emotional Titan — Powered by Feelings, Not Logic

This titan awakens when you:

- Have a bad day

- Fight with someone

- Feel disappointed

- Want to celebrate

- Feel lonely

You tell yourself:

“I deserve this.”

“It will make me feel better.”

“It’s a reward.”

But the emotional titan doesn’t care about your future peace.

Hero Strategy:

Replace emotional spending with healthier coping mechanisms:

- Listening to anime soundtracks

- Going for a walk

- Journaling

- Calling a friend

- Drinking water

- Watching one episode of motivational anime

Take back control from the titan.

5. The Lifestyle Curse — The Evolving Villain

This is a long-term curse that activates when income increases.

You get a raise → you upgrade everything.

You switch jobs → new phone, new clothes.

You start earning → eating out becomes routine.

Lifestyle inflation feels like leveling up…

But it’s a trap.

Income increases → expenses increase → savings remain unchanged.

Hero Strategy:

Increase savings before increasing lifestyle.

With all monsters identified, we now move into battle strategy mode.

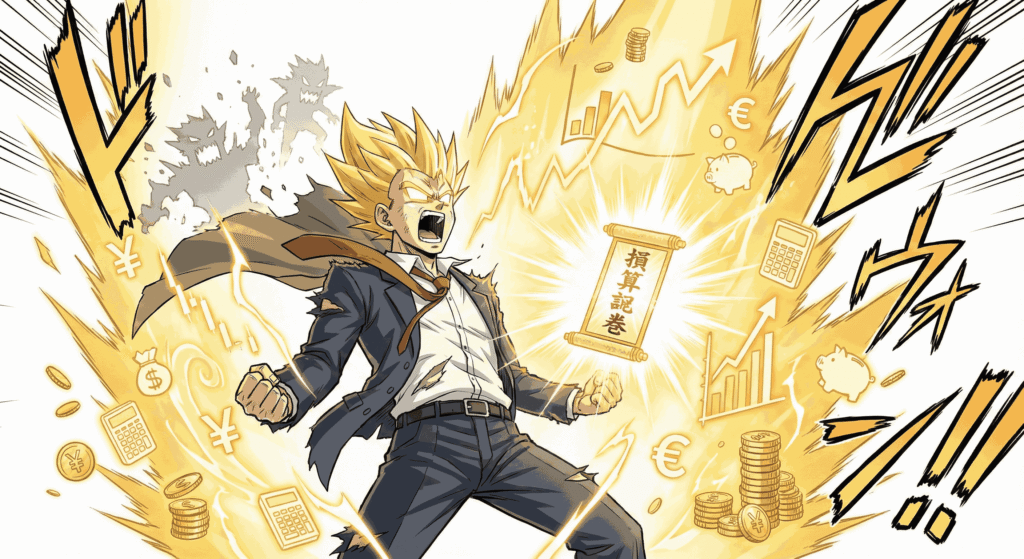

Chapter 2: The Hero Awakens — Your Budgeting Transformation Arc

If expenses are monsters…

Then budgeting is your Super Saiyan transformation.

Budgeting doesn’t restrict you — it protects you.

Let’s start building your hero power.

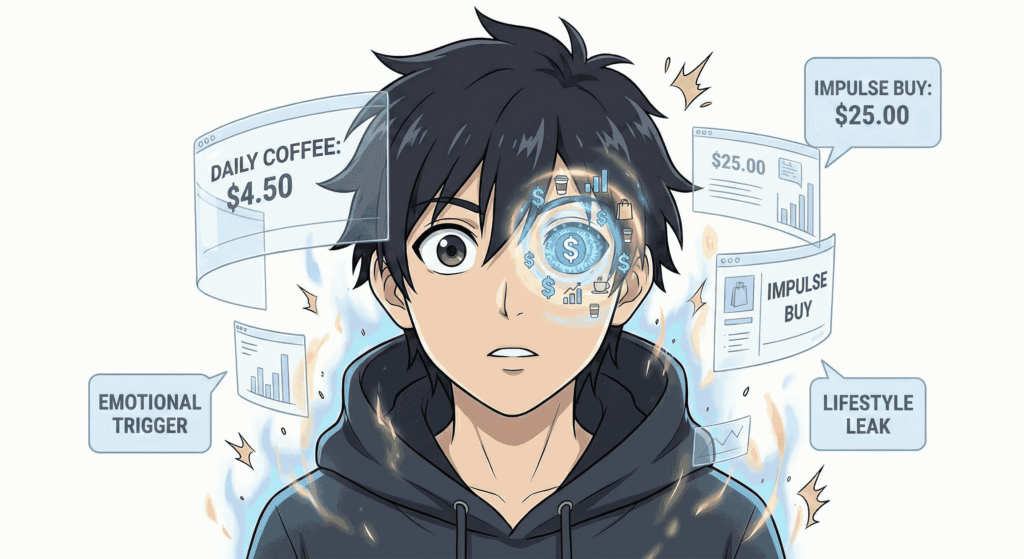

Step 1: Activate Awareness Mode (The Protagonist’s Eye-Opening Moment)

Every anime hero has a moment where they finally see the truth.

Your truth:

You don’t know where your money goes.

Awareness is your Sharingan — it reveals everything.

Track expenses daily for just 7 days.

What you gain:

- A clear idea of spending habits

- Realization of wasteful expenses

- Understanding emotional patterns

- Awareness of lifestyle leaks

Without awareness, no budgeting can save you.

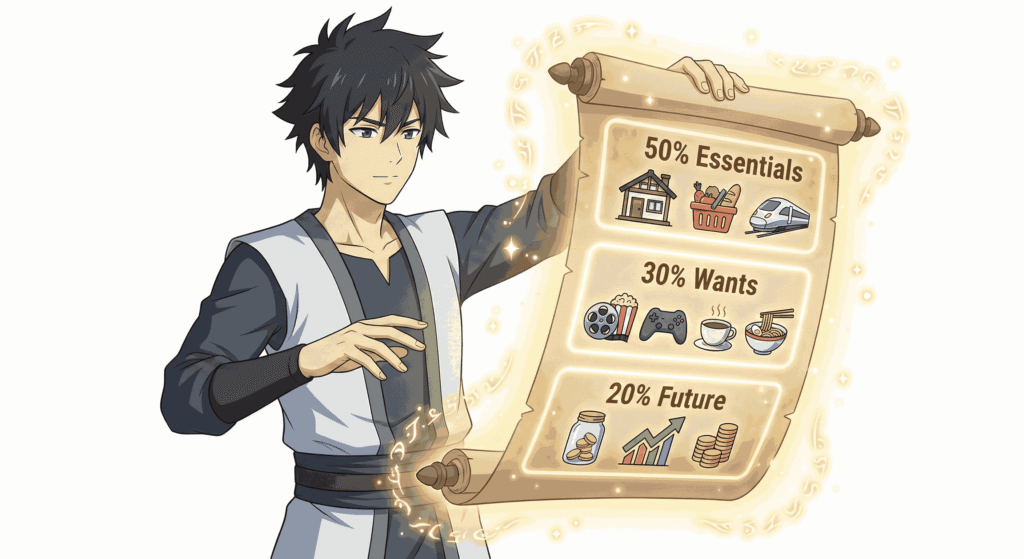

Step 2: Create the Hero’s Budget Scroll

Your budget scroll divides your money into simple categories.

Use the 50/30/20 Formula (Anime Budget Jutsu):

- 50% — Essentials (Team Life Support): rent, groceries, transport

- 30% — Wants (Team Enjoyment): movies, gaming, eating out

- 20% — Future Arc (Team Legacy): savings, investments

This scroll is flexible.

But it adds structure, clarity, and peace.

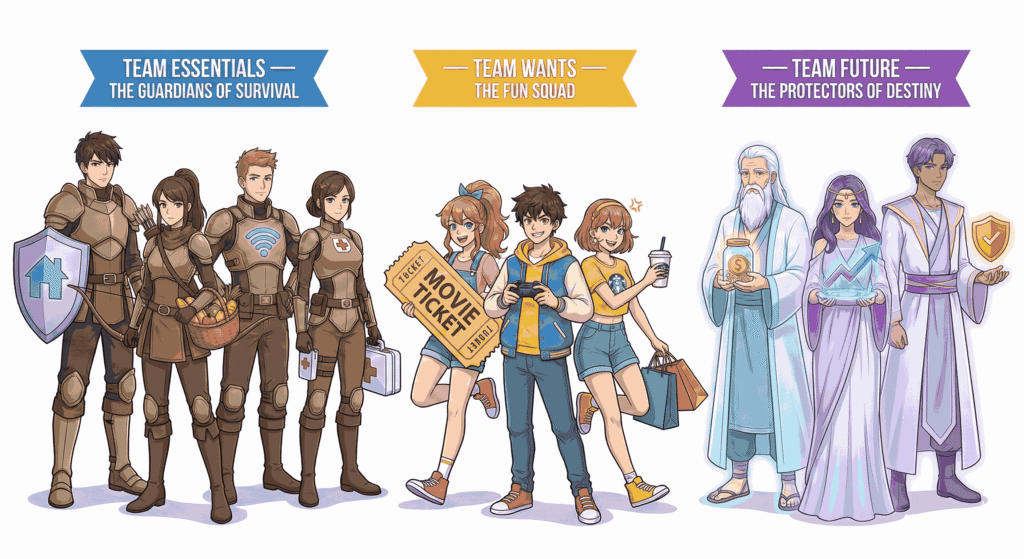

Step 3: Build Your Expense Control Squad

Just like every anime protagonist has a team, your money categories are your squad.

Team Essentials — The Guardians of Survival

Rent

Groceries

Utilities

Internet

Medicine

These are the responsible adults of your financial anime.

Team Wants — The Fun Squad

Netflix

Temple Run gems

Starbucks

Weekend shopping

They bring joy — but they need discipline.

Team Future — The Protectors of Destiny

Savings

Investments

Emergency fund

This team ensures long-term stability.

Step 4: Deploy the Anti-Impulse Shield (3-Day Rule Jutsu)

Whenever temptation appears:

Pause.

Wait 3 days.

Ask: Do I still want it?

90% of impulse desires die in 72 hours.

This technique alone can save you thousands monthly.

Step 5: Five-Minute Daily Money Meditation

Every great hero trains daily.

Your training:

- Check yesterday’s expenses

- Update your tracker

- Review your budget scroll

- Note any leaks

- Set a micro-goal

This daily ritual builds mental strength like a training montage.

Chapter 3: Advanced Hero Techniques — Unlocking Your Skill Tree

Once you’ve mastered the basics, you can explore advanced strategies.

Let’s dive into the skill tree.

Technique 1: The Envelope System Jutsu

This is an old-school, incredibly effective method.

You allocate money into physical envelopes labeled:

- Food

- Travel

- Entertainment

- Savings

When an envelope is empty, the mission ends.

This visually clear system prevents overspending better than any app.

Technique 2: Auto-Debit Summoning Technique

If anime heroes can summon beasts,

You can summon automatic savings.

Set auto-transfers for:

- SIPs

- Recurring deposits

- Savings accounts

- Emergency funds

Pay your future self first.

Let the leftover money be your spending money.

This is the smartest financial hack ever.

Technique 3: Activate Expense Freeze Mode

In anime, freeze techniques stop time.

In finance, freeze mode stops unnecessary expenses during tough months.

Use freeze mode when:

- Salary is delayed

- Emergency arises

- Travel expenses spike

- You overspent last month

Rules:

- No takeout food

- No new clothes

- No subscriptions

- Essentials only

This mode prevents financial collapse.

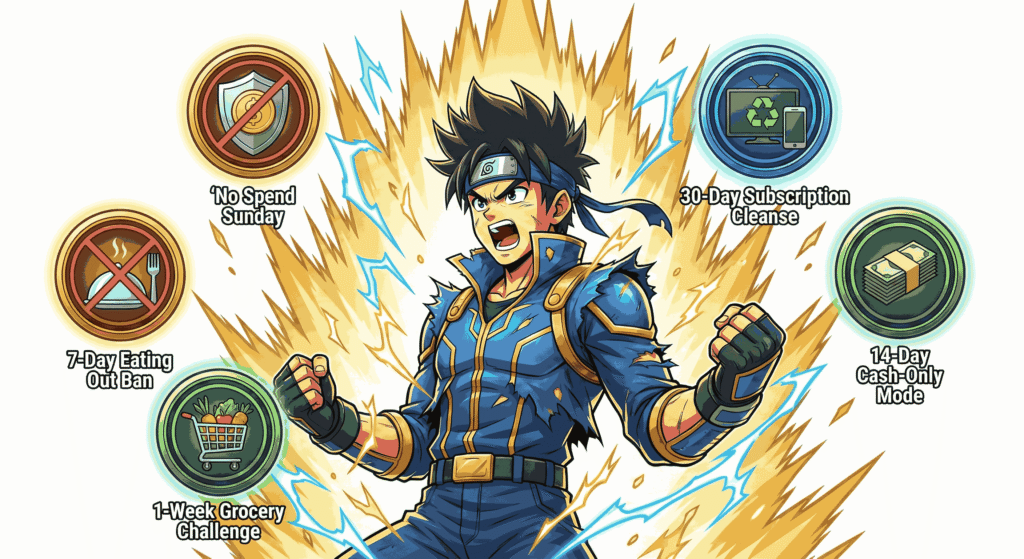

Technique 4: Limit Breaker Budget Challenges

Anime characters unlock new power levels by pushing limits.

So can you.

Try:

- No Spend Sunday

- 7-Day Eating Out Ban

- 1-Week Grocery Challenge

- 30-Day Subscription Cleanse

- 14-Day Cash-Only Mode

Gamification makes budgeting fun and rewarding.

Technique 5: Reverse-Engineering Your Month (Time Travel Technique)

Instead of figuring out expenses after spending…

Plan your month before it starts.

Your mission plan:

- Weekly food budget

- Weekly entertainment limit

- Fixed grocery amount

- Transport budget

- Learning budget

Planning = fewer surprises = fewer monsters.

Chapter 4: The Emotional Arc — Taming the Inner Monster

Every anime hero faces one big challenge:

Their inner demons.

In finance, your emotional reactions create 80% of bad spending decisions.

Let’s understand and defeat them.

1. The “Comparison Curse” Villain

Scrolling Instagram can make you feel:

- Behind

- Inadequate

- Pressured

This triggers lifestyle spending purely for validation.

Counter-spell:

“I upgrade my life based on my goals, not others’ highlight reels.”

You can’t win the comparison game.

You can win the discipline game.

2. The “Reward Myself” Boss Fight

After a long week, your brain goes:

“You deserve it.”

“Just this once.”

“One treat won’t hurt.”

But these “once in a while” treats occur 12 times a month.

Hero Strategy:

- Weekly micro-reward ($10–$20)

- Monthly big reward ($50–$100)

- Yearly grand reward (travel, gadgets, etc.)

Planned enjoyment is guilt-free and affordable.

3. The “Stress Shopping” Demon

Buying things to escape stress is extremely common.

But the relief lasts minutes, while the financial impact lasts months.

Hero Replacement Moves:

- Deep breathing

- Cleaning your room (instant mood booster)

- Watching a motivational anime scene

- Sitting quietly for 2 minutes

- Journaling your feelings

- Going outside for fresh air

Regulate emotion → Regulate spending.

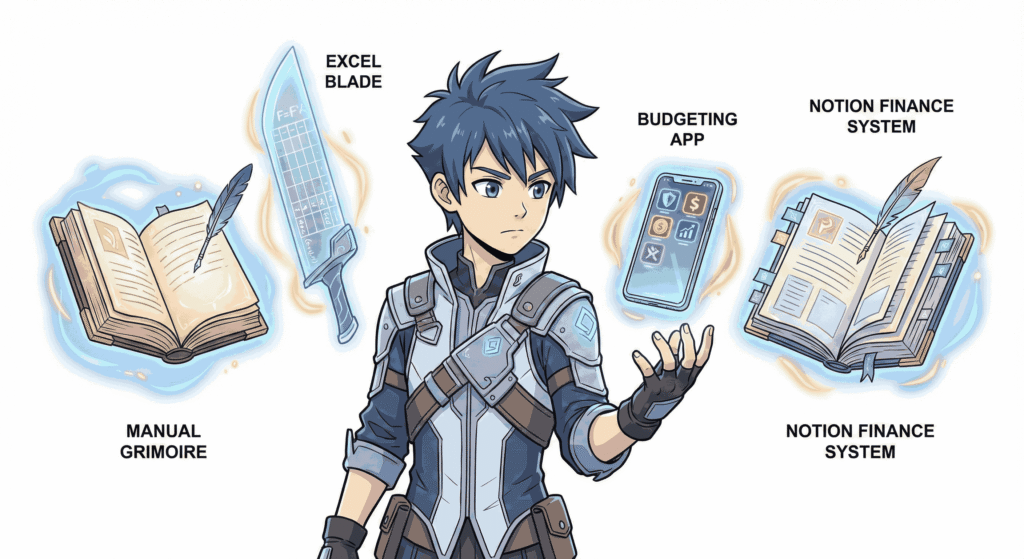

Chapter 5: Choose Your Weapons — Tools for Heroic Budgeting

Every anime hero has weapons, spells, or technology.

You have budgeting tools.

1. Notebook (The Personal Grimoire)

Perfect for:

- Manual tracking

- Writing insights

- Cultivating mindfulness

Surprisingly powerful.

2. Google Sheets / Excel (The Strategist Dashboard)

Great for:

- Monthly analysis

- Spending charts

- Growth progress

- Goal-setting

Makes budgeting visual and logical.

3. Budgeting Apps (Digital Familiars)

Use apps like:

- Money View

- Walnut

- Spendee

- Fudget

- GoodBudget

They automatically track expenses — like loyal digital pets.

4. Notion Finance HQ (The All-Purpose Magic Spellbook)

Notion lets you:

- Track expenses

- Monitor subscriptions

- Visualize progress

- Build dashboards

It’s like having a full anime command center for your money.

Chapter 6: The Boss Battle — Your First Real Financial Victory

Imagine this:

It’s the last day of the month.

Instead of fear…

Instead of praying your account isn’t empty…

You check your bank balance and smile.

Because for the first time:

- You spent with awareness

- You avoided traps

- You followed a budget scroll

- You said “no” when needed

- You saved intentionally

This moment is HUGE.

This is your first boss defeat.

Once you taste this victory, you won’t want to go back.

This is where your financial anime truly shifts into a new arc.

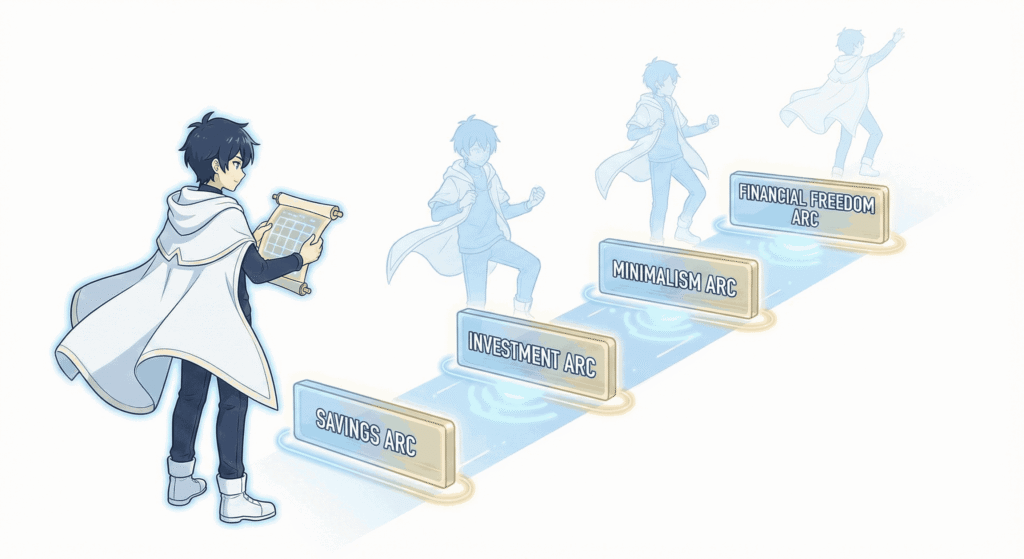

Chapter 7: Long-Term Hero Arcs — Becoming a Master Strategist

Short-term victories are great.

But anime legends are known for consistency.

Let’s build long-term arcs.

1. The Savings Arc (Building Your Protective Armor)

Build:

- $1,000 starter fund

- 1-month emergency fund

- Then 3 months

- Eventually 6 months

This ensures that no job loss, medical emergency, or unexpected expense can break your stability.

2. The Investment Arc (Your Post-Timeskip Power Upgrade)

Start simple:

- Index funds

- SIPs

- Mutual funds

- Basic stock market learning

Investing is where your money works FOR you.

This is the equivalent of unlocking Sage Mode or Bankai.

3. The Minimalism Arc (Decluttering Your Life and Expenses)

Minimalism doesn’t mean “own nothing.”

It means:

- Buy only what adds value

- Reduce digital and physical clutter

- Make decisions easier

- Spend consciously

Clarity in life → Clarity in finances.

4. The Financial Freedom Arc (The Final Transformation)

Financial freedom means:

- Your passive income is higher than your monthly expenses

- You can choose the life you want

- Money becomes your ally, not your enemy

This is the ultimate hero form.

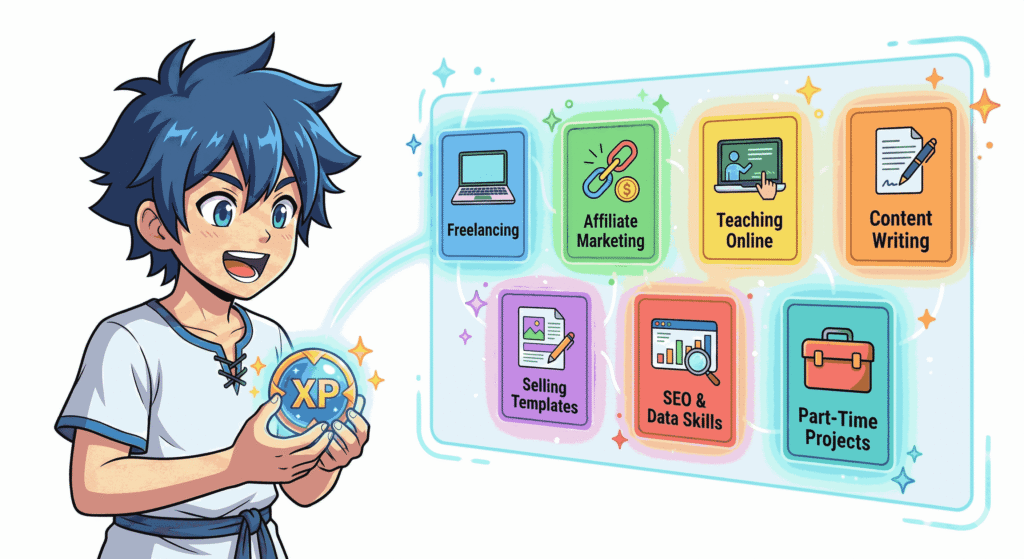

Chapter 8: Side Quests — Boost Your XP (Income)

Side quests in anime aren’t optional — they help heroes grow.

Side income does the same.

Try:

- Freelancing

- Affiliate marketing

- Teaching online

- Content writing

- Selling templates

- Offering skills like SEO, editing, and data analysis

- Part-time projects

More income = faster progress = stronger hero.

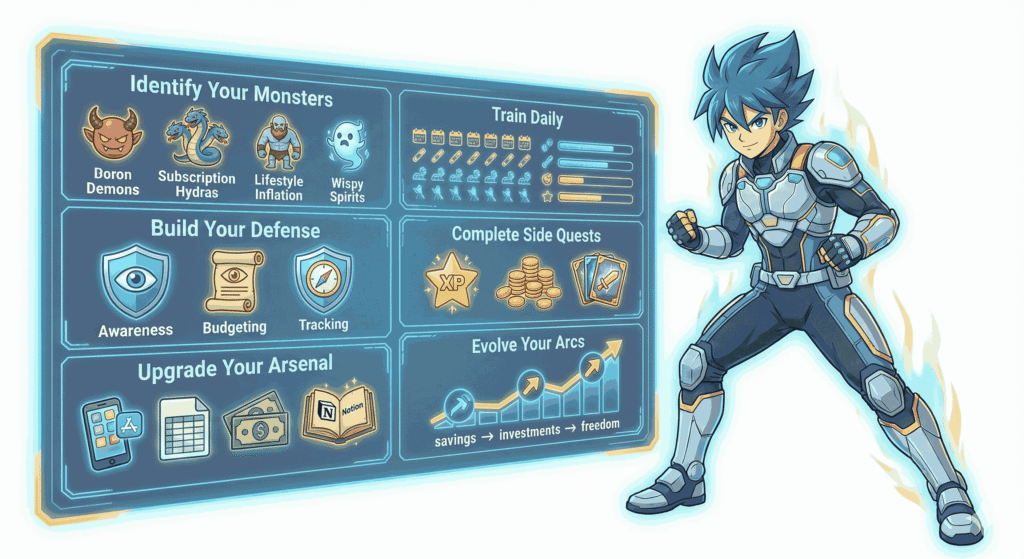

Chapter 9: Your Hero Blueprint — Quick Summary

Here’s your cheat sheet:

✔ Identify your monsters

Impulse, subscriptions, lifestyle inflation, and emotional shopping.

✔ Build your defense

Budgets, awareness, and daily tracking.

✔ Upgrade your arsenal

Apps, spreadsheets, Notion, envelopes.

✔ Train daily

Small habits → massive long-term impact.

✔ Complete side quests

Build new income streams.

✔ Evolve your arcs

Savings → investments → freedom.

You’re not just budgeting —

You’re becoming a financial warrior.

Final Chapter: Stand Tall, Hero — Your Financial Anime Has Just Begun

No one becomes a hero overnight.

Heroes are built through:

- Micro choices

- Daily habits

- Discipline

- Awareness

- Courage to change

Your expenses aren’t villains to fear —

They’re challenges designed to make you stronger.

Every time you choose budgeting over impulse,

discipline over emotion,

planning over chaos…

You level up.

Your future self — wiser, wealthier, calmer —

will look back and thank you for starting this journey.

Your financial anime is waiting.

And you — the hero — are finally ready.

Let the budgeting arc begin.

And may your expenses never defeat you again.

Other Interesting Posts To Read:

Stock Market Saga: Investing Lessons from Epic Anime Journeys

Upgrade Your Money Mana: Skills Every Anime Fan Should Know for Smart Spending

Financial Villains to Watch: Anime-Style Analogy for Hidden Money Traps

Anime-Inspired Minimalism: Declutter Your Wallet, Boost Your Wealth

Crypto & Coins: Exploring Digital Finance Through an Anime Portal