Saving $10,000 a Month Challenge — The Anime Power-Up Method helps you turn saving into a fun, disciplined journey using an anime-style mindset, systems, and power-up strategies to build elite financial habits step by step.

Welcome to an engaging journey where financial wisdom meets the whimsical world of anime! If you’ve ever felt overwhelmed by your savings goals or unsure how to supercharge your financial habits, you’re not alone.

But what if I told you that you could harness the same determination and creativity found in your favorite anime heroes to achieve a seemingly impossible challenge: saving $10,000 a month?

Buckle up as we exploredynamic strategies inspired by anime, coupled with practical financial tips, ensuring that you not only meet your savings goals but also have a blast along the way!

Understanding the $10,000 Savings Challenge

Saving $10,000 a month may sound daunting, but let’s break it down. This challenge isn’t just about the number; it’s about cultivating discipline and a mindset that spurs on creativity in your saving methods.

Think of it as training for a marathon. Just as athletes don’t jump straight into running 26.2 miles without preparation, you won’t dive into saving $10,000 without a plan.

Benefits of High Savings Goals

- Financial Security: A robust savings habit creates a cushion for emergencies and future investments.

- Freedom and Opportunity: With substantial savings, you unlock travel opportunities, starting a business, or personal development.

- Empowerment: Achieving a significant savings goal can foster a sense of accomplishment and boost your confidence.

The Anime Influence: Why It Works

Anime often portrays journeys filled with challenges, perseverance, and character growth. The narratives are perfect illustrations of how adopting a “power-up” method can change one’s path toward success.

Let’s draw some parallels:

Lessons from Anime Heroes

- Determination: Characters like Naruto or Goku never give up, even against overwhelming odds. This relentless drive can inspire you to push through financial challenges.

- Community Support: Just as anime heroes often rely on their friends, don’t hesitate to lean on family or friends for support. Sharing your goals can lead to encouragement and collaboration.

- Adaptability: Anime characters often find creative solutions to unique problems. Adaptability in your savings strategy can lead to innovative wealth-building methods.

Creating Your Personal Savings Hero

Start by outlining the qualities of your personal savings hero. What drives them? What values do they embody? Perhaps they are resourceful, disciplined, and positive. These traits should guide your saving habits.

1. Set Your Goal

Translate your overarching savings aim into actionable, smaller goals. For instance, if saving $10,000 feels intimidating, break it down into weekly or daily targets that seem more manageable.

2. Visualize Your Journey

Just as anime characters have training arcs and epic transformations, visualize your journey. Create a vision board illustrating your savings goals—whether it’s a new car, a dream vacation, or a cozy home. This serves as a motivational reminder of what you’re working toward.

Strategies for Saving Big

Now, let’s dive into specific methods you can integrate into your savings approach, inspired by the strategic brilliance often displayed in anime.

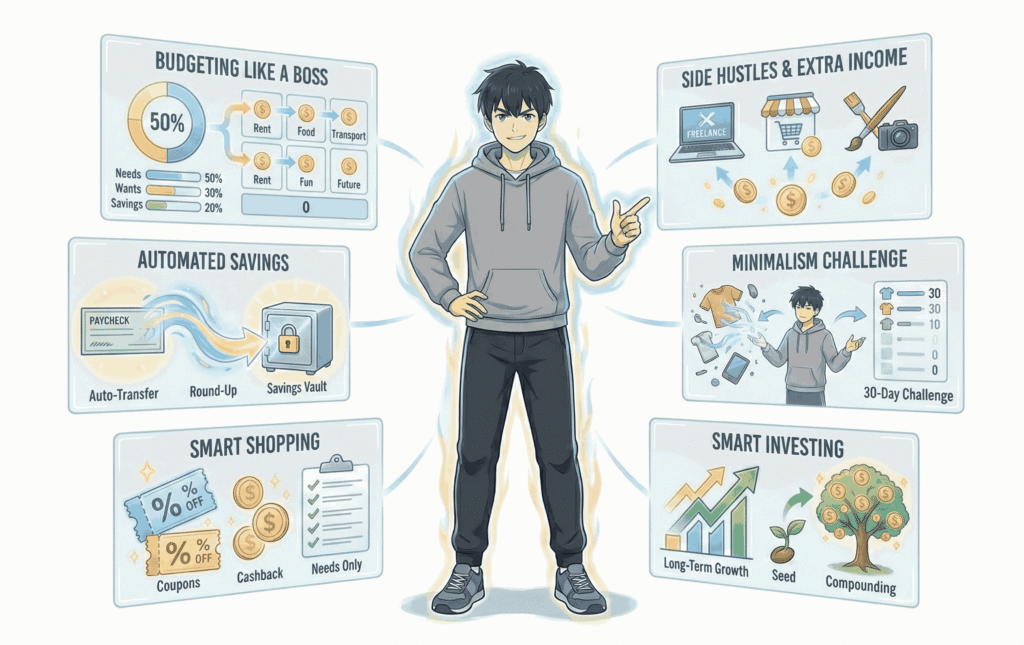

1. Budgeting Like a Boss

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings. Adjust the percentages to better fit your goal of saving $10,000.

- Zero-Based Budgeting: Ensure every dollar has a purpose by assigning it to specific expenses or savings until your income minus expenses equals zero.

2. Automated Savings

- Set up automatic transfers to your savings account each payday. Think of it as a ‘power-up’ for your savings.

- Use apps that round up your purchases to the nearest dollar and transfer the difference into savings.

3. Side Hustles and Extra Income

- Channel your inner protagonist by taking on side jobs. Consider freelance work, teaching lessons, or starting a small online business.

- Use platforms like Etsy or Fiverr to monetize skills or hobbies you may have.

4. Delve into Minimalism

- Embrace a minimalist lifestyle for a month. Live with only essential items, and sell what you don’t need. The income you generate can be funneled directly into savings.

- Use the “30-Day Minimalism Game” concept: get rid of 1 item on day 1, 2 items on day 2, and so forth.

5. Smart Shopping

- Use coupons and cash-back apps to lower your expenses. Think of it as ‘powering up’ in the financial realm!

- Plan your meals and shopping trips to reduce impulse buys.

6. Invest Wisely

- Learn about investment options like stocks, bonds, or index funds to grow your wealth. The earlier you start, the more your money can compound—think of it as training for long-term success.

- Look into high-yield savings accounts or certificates of deposit (CDs) to maximize interest.

Staying Motivated: Leveling Up Your Savings

Achieving your financial goals requires consistent motivation. Here are tips to keep your spirits high:

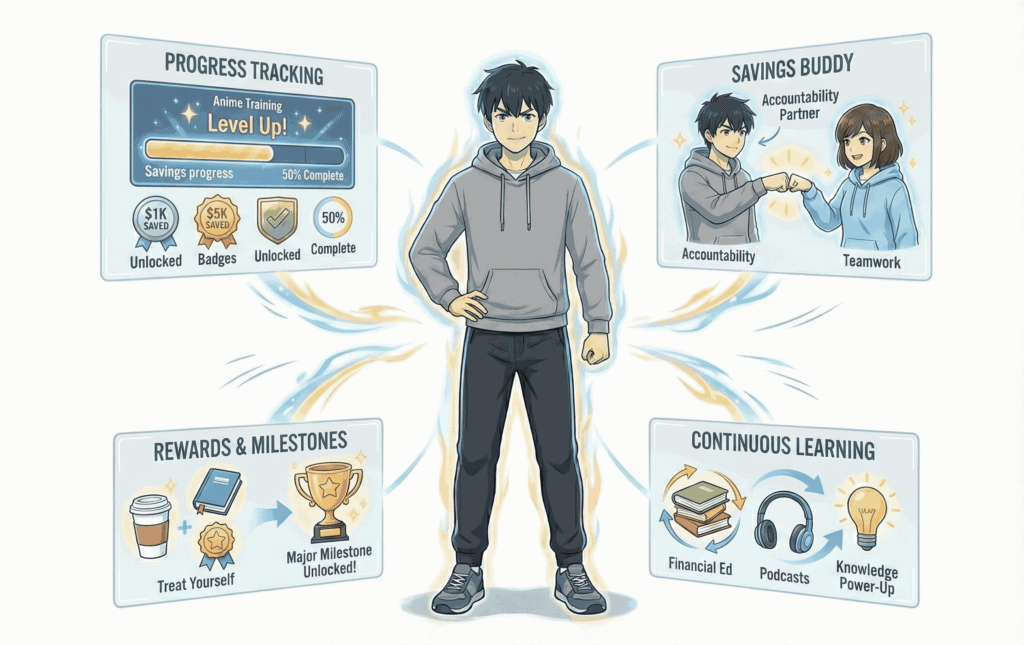

1. Track Your Progress

- Keep a visual tracker akin to an anime character’s training progress chart. Document your saving milestones and celebrate each achievement.

- Use apps that gamify your savings experience, providing rewards and milestones to keep you engaged.

2. Find a Savings Buddy

- Partner with a friend or family member who also wants to save. Share progress, tips, and encouragement—creating a supportive community atmosphere, just like in your favorite shows.

3. Reward Yourself

- Celebrate your progress, but do so responsibly. Consider small, budget-friendly treats as rewards for meeting your savings goals.

- Set larger rewards for significant milestones, reminiscent of epic battles won in anime sagas.

4. Keep Learning

- Just as anime characters continuously learn and grow, immerse yourself in financial education. Read books, attend workshops, and listen to podcasts about personal finance.

Final Thoughts and Next Steps

Saving $10,000 a month is a monumental goal, but with creativity, determination, and strategic planning influenced by the adventures of anime heroes, you can transform this challenge into reality.

Remember, gradual progress is still progress. Embrace the journey, adapt your strategies, and never hesitate to seek support on your unexpected adventure towards financial success.

As you embark on this challenge, think of the heroes you admire and embody their traits. The road to saving may have its challenges, but with perseverance, you’ll not just reach your goal—you’ll have a blast along the way! Now, it’s time to power up and get started on your saving journey!

Other Interesting Posts To Read:

Emergency Fund Explained with an Anime Survival Story

How to Stop Impulse Spending Using Anime Discipline Techniques

Daily Money Habits That Turn You Into a Financial Superhero (Anime Edition)

Create Your Financial Anime Arc: Planning Money Milestones Like a Series

Power-Up Your Wealth Tree: Growth Investing with Anime Tropes

[…] Saving $10,000 a Month Challenge — The Anime Power-Up Method […]