Emergency Fund Explained with an Anime Survival Story shows why saving 3–6 months of expenses is your real-life survival kit.

Learn how to build, store, and use an emergency fund through a powerful anime-style journey—simple, practical, and stress-free.

You’re cozied up, deep into your favorite anime, cheering as that scrappy hero dodges explosions, outsmarts the bad guys, and pulls off an epic comeback.

Those nail-biting moments, the late-night episodes, that rush when they power up? That’s the vibe. Now, hear me out—building an emergency fund feels just like prepping your own inner hero for life’s curveballs. No fancy gear needed, just some smart, everyday moves.

Today, I’m sharing this through a fun, original anime story I dreamed up. Meet Kai, an ordinary guy thrown into a brutal wasteland survival tale.

His ups and downs? They mirror our financial struggles perfectly—from feeling lost to emerging stronger.

We’ll cover what an emergency fund really is, why it matters so much, how to determine your target amount, where to keep it safely, and easy ways to build it without stress. I’ll even toss in some handy tools to make it automatic.

Grab a snack, fellow anime fan and money adventurer. This isn’t some dry lecture—it’s your personal survival guide, wrapped in a story that’ll stick with you. Ready to channel your inner Kai?

Kai’s Rough Start: When Everything Falls Apart

Let’s set the scene in Neo-Tokyo, year 2147—a shiny city running on magical energy crystals. Kai’s 25, slinging ramen at a little stall, unwinding with Attack on Titan marathons after long days.

He dreams of mining those crystals for big bucks, but savings? Zero. “Eh, life’s good enough,” he figures. “Rent’s covered. What could go wrong?”

Then—bam. A huge earthquake wrecks the main reactor. Crystals shatter, lights go out, food disappears, and gangs like the ruthless Shadow Clans and slick Elite Enforcers start fighting over what’s left.

Kai digs out from rubble, his stall gone, pockets empty. No family nearby, no plan. He’s got maybe two days before hunger or worse gets him.

How This Hits Home: Sound familiar? That’s life without an emergency fund. A layoff, surprise doctor bill, car that dies—stuff happens fast.

The 2024 Federal Reserve survey found 40% of Americans couldn’t handle a $400 surprise. And with gig jobs like Uber or DoorDash?

A 2025 Bankrate report says 57% of us are living check-to-check. Kai’s mess is that empty bank feeling when reality strikes.

But here’s the spark: Kai recalls his grandpa’s old “survival kit” hidden in the family shrine. He claws it out—water filters, protein bars, a handy knife, solar charger. Not a fortune, but enough to breathe and think. It gives him a fighting chance.

Your Takeaway: Think of an emergency fund as your kit. Aim for 3-6 months of basic living costs, tucked somewhere safe and easy to grab. Save it for true crises—like medical stuff (US families often face $5,000+ surprises yearly) or job gaps—not that impulse anime merch.

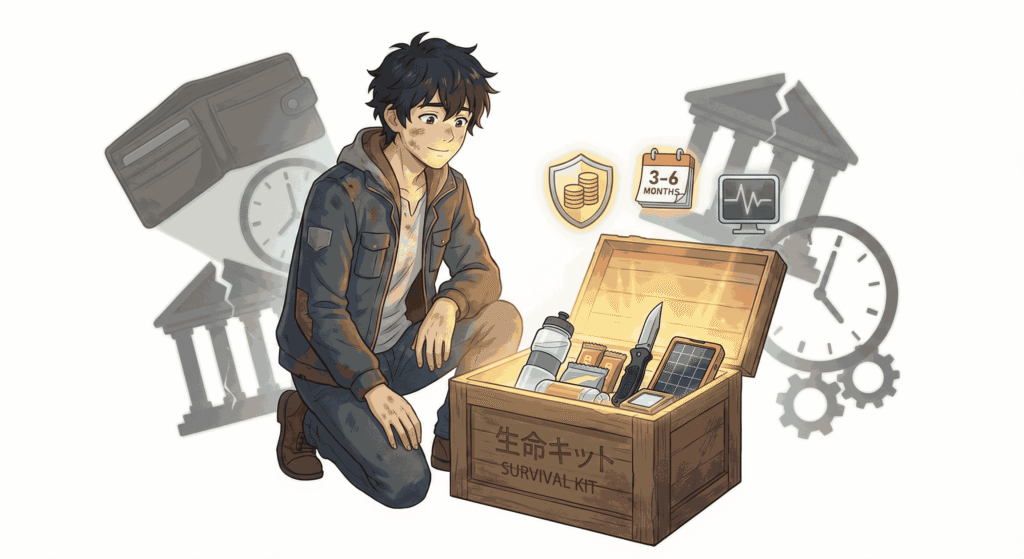

Building Strength: Stocking Up, Step by Step

Kai munches a bar, energy surging, but he knows it won’t last. The wasteland’s unforgiving, so he gets clever—scouting ruins, trading skills for gear.

Fixes a generator, swaps noodles for meds. His backpack grows: batteries, a first-aid kit, even a bow. Little by little, he’s tougher, ready for more.’

Step 1: Figure Out Your Needs

No guessing—let’s math it out simply, like planning your hero stats.

Say your basics run $2,350/month: rent ($1,200 in a mid-sized city), groceries ($400), bills ($200), gas ($150), debt payments ($300), insurance ($100).

- Starter goal: 3 months = $7,050 (if you’re single with steady work).

- Solid goal: 6 months = $14,100 (family or gig life).

- Extra cushion: 9-12 months for shaky jobs like freelancing.

Easy formula:

Your Fund=Monthly Basics×Months You Want Covered

Kai starts small, covering a week, then builds. You can too—baby steps add up.

Step 2: Smart Spots to Stash It

Like Kai picking durable supplies, choose reliable options:

- High-yield savings: 4-5.5% interest (Ally or SoFi apps hit 5%+, FDIC-protected).

- Money market funds: Quick-cash chunk (Vanguard/Fidelity apps are beginner-friendly).

- Skip: Stocks (too bumpy), houses (can’t sell fast), or regular checking (interest? Zilch).

Here’s a gentle nudge: Automate it. After payday, transfer $200 auto-magically. Watch it grow like compound interest magic.

Fun Nod to Anime: Luffy from One Piece trains Haki bit by bit for god-tier power. Your fund’s the same—steady habits create real strength.

The First Big Test: When Trouble Strikes Hard

Weeks pass. Kai’s set up a safe shack, made survivor friends, got a rhythm: mornings foraging, afternoons practicing shots. Life’s okay. Then—ambush.

Shadow Clans hit at dawn, snag half his stuff. A fighter slashes his leg; it festers fast. Heart racing, he dips into his kit: bandages, antibiotics.

Rations tight, he trades the knife for healer help. It costs big, but he pulls through—with new smarts and a story to tell.

Real-Life Version: Those “ambushes” we all dread?

- Layoff: Pays rent while job hunting (US unemployment is at 4.2% in 2025).

- Health hit: $2,000 ER? Covered (after that $1,600 deductible average).

- Car trouble: $1,500 fix? No sweat.

- Family stuff: Weddings, losses—they sneak up.

Key Rules: Only for real emergencies—life-or-limb stuff. Phone upgrade? Wait. Pet crisis? If critical, okay. Apps like Mint or YNAB help track it guilt-free.

Rebuild Fast: Kai scavenges harder after. You? Refill in 3 months max. Bonuses or refunds? Straight to the fund.

Proof it works: 2025 Vanguard data shows 6-month funds help folks bounce back from tough times 50% smoother, debt-free.

Facing Bigger Foes: Keeping It Going Long-Term

Kai’s rep spreads—“Ramen Survivor.” But tougher enemies wait: Elite Enforcers with drones and endless gear. They block roads, push him to the toxic Badlands. Fund dips—bike fuel, rad pills. Hunger knocks.

His turnaround: Spots a crystal vein. Grinds to mine it, trades for buddies. A gadget friend crafts a shield. Now Kai leads, turning defense to offense.

Pro Moves for You:

- Layers: Tier 1 (1 month, checking). Tier 2 (2-3 months, savings). Tier 3 (CDs/markets).

- Beat Inflation: 3% US rate nibbles cash—pick 5%+ yields.

- Family Twist: Add kids’ costs ($500/month?).

- Gig Tip: Uber/Fiverr folks, go 9 months—earnings swing.

Helpful Apps (affiliate-friendly!):

- Acorns/Wealthfront: Rounds up purchases, invests smart.

- Chime/Current: Free, instant saves.

- Rocket Money: AI spots leaks, auto-saves.

That shield vibe? A good fund cuts stress 70%, per 2025 Fidelity—more energy for your passions.

Epic Finale: Claiming Your Win

Grueling months later, Kai rallies folks for the Overlord’s fortress—mechs everywhere. Fund’s low but proven. Boss unleashes “Debt Vortex,” pulling everything in. Kai shields, stalls, and smashes the crystal heart. City revives. Legend status.

Your Big Picture: Fund preps you for investing (Robinhood ETFs at 10-15%), debt kills (22% cards first), or scaling side hustles like affiliates (Ahrefs for SEO, Jasper for writing).

US Perks:

- HSA/FSA: Tax-free health bucks ($4,150/year).

- Roth IRA: Grows free.

- 401(k): Free employer match.

Kai mentors after. You could too—share with pals, blog it.

Your Easy Action Plan

- Track spending for a month (Google Sheets works).

- Trim extras (one streaming sub? Save $100).

- Side gig it (DoorDash $500? To the fund).

- Set auto-transfers.

- Check every 3 months—life shifts.

Quick Fund Guide:

| You Are… | Monthly Costs | Target Fund |

|---|---|---|

| Single, Steady Job | $2,000 | $6K-$12K |

| Family, Suburbs | $4,000 | $12K-$24K |

| Gig Worker | $2,500 | $15K-$30K |

| Freelancer | $3,000 | $27K+ |

Why This Changes Everything

Kai’s story? It’s us, unlocked. No stash, he’s done. With it? Victorious. In 2025’s wild ride (AI changes, 3% inflation), this fund quiets worries, lets you chase dreams, and builds real security.

Start small today—like Kai’s first dig. Six months from now? You’ll feel unstoppable.

Your Hero Arc Starts Now: Wrap-Up and Next Steps

And just like that, Kai’s wasteland saga ends not with a whimper, but a bang—city saved, legend born, all thanks to that humble survival kit he dug up in hour one.

It’s a reminder: Preparation isn’t about predicting every plot twist; it’s about having the tools to rewrite the story when chaos hits.

Here’s the heart of it, friend: Your emergency fund is that kit. Whether it’s $6,000 for a solo hustler or $30,000+ for a family grinding gigs, it’s 3-6 (or more) months of basics in a high-yield spot like Ally or Acorns—automated, liquid, and raid-proof for true emergencies only.

We’ve crunched the math, dodged the Shadows, outlasted the Enforcers, and slayed the Overlord. Now stats prove it: Folks with solid funds cut stress by 70%, dodge debt traps, and pivot faster in 2025’s wild economy.

Other Interesting Posts To Read:

How to Stop Impulse Spending Using Anime Discipline Techniques

Daily Money Habits That Turn You Into a Financial Superhero (Anime Edition)

Create Your Financial Anime Arc: Planning Money Milestones Like a Series

Power-Up Your Wealth Tree: Growth Investing with Anime Tropes

Upgrade Your Money Mana: Skills Every Anime Fan Should Know for Smart Spending

[…] Emergency Fund Explained with an Anime Survival Story […]