Unlock your financial future with our comprehensive guide on how to start investing with just $100. Discover practical strategies, investment options, and tips for beginners. Start building wealth today!

Investing is often perceived as a domain reserved for the wealthy or those with extensive financial knowledge. However, the truth is that anyone can start investing—even if you have just $100 to spare.

Investing can be intimidating, particularly if you have little money to start with. The idea that you need thousands of dollars to start investing, however, is untrue.

You can start down the road to financial freedom and success with as little as $100. The secret is to get started early, make wise decisions, and maintain consistency.

Everything you need to know about beginning your investing career with just $100 will be covered in this article.

This blog will give you the information you need to start accumulating wealth, from comprehending the fundamentals to investigating investing choices.

Why Invest?

Before diving into the “how,” it’s crucial to understand the “why.” Investing allows your money to grow over time, helping you build wealth, achieve financial independence, and secure your future.

As Warren Buffett once said, “The stock market is designed to transfer money from the Active to the Patient.” By starting early, even with a small amount, you can benefit from compound interest and the power of time.

How to Start Investing with Just $100:

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

Investing with $100 might seem insignificant, but it is a powerful step toward financial security.

Here’s why starting small can make a big impact:

- Compounding Growth: Even small amounts grow exponentially over time due to compounding interest. Starting early ensures your investments have time to multiply.

- Building the Habit: By starting small, you create the habit of saving and investing, which is crucial for long-term financial success.

- Learning the Ropes: With $100, you can experiment and learn about investing without the fear of significant financial loss.

Step 1: Set Your Investment Goals:

Before investing, define your financial goals.

- Short-Term Goals: If you aim to achieve something within a year or two, consider low-risk investments like savings accounts or short-term bonds.

- Long-Term Goals: For goals further down the line, such as retirement, you can afford to take on more risk with stocks or mutual funds.

Before you start investing, it’s important to define your goals. Ask yourself:

- What am I investing for? (Retirement, education, vacation, or building wealth?)

- What is my risk tolerance? (Low, moderate, or high?)

- What is my time horizon? (Short-term, medium-term, or long-term?)

SMART Goals Framework:

To create effective goals, consider the SMART criteria:

- Specific: What exactly do you want to achieve?

- Measurable: How will you track your progress?

- Achievable: Is your goal realistic?

- Relevant: Does it align with your overall financial strategy?

- Time-Bound: What is your deadline?

Example Goals:

- Save for a $10,000 emergency fund within 5 years.

- Accumulate $1 million for retirement by age 60.

- Grow your $100 to $1,000 in 3 years.

Step 2: Educate Yourself

Before diving in, understanding the basics of investing is crucial. Here are some must-know concepts:

- Stocks: Shares of ownership in a company that can grow in value over time.

- Bonds: Loans you give to corporations or governments with fixed returns.

- ETFs (Exchange-Traded Funds): Investment funds that hold a variety of assets and trade on stock exchanges.

- Diversification: Spreading your money across different investments to reduce risk.

- Risk vs. Reward: Higher-risk investments often offer higher potential returns but come with greater chances of loss.

Free Resources:

- Websites like Investopedia and NerdWallet

- Investment books such as The Intelligent Investor by Benjamin Graham.

- Free courses on platforms like Coursera or Udemy.

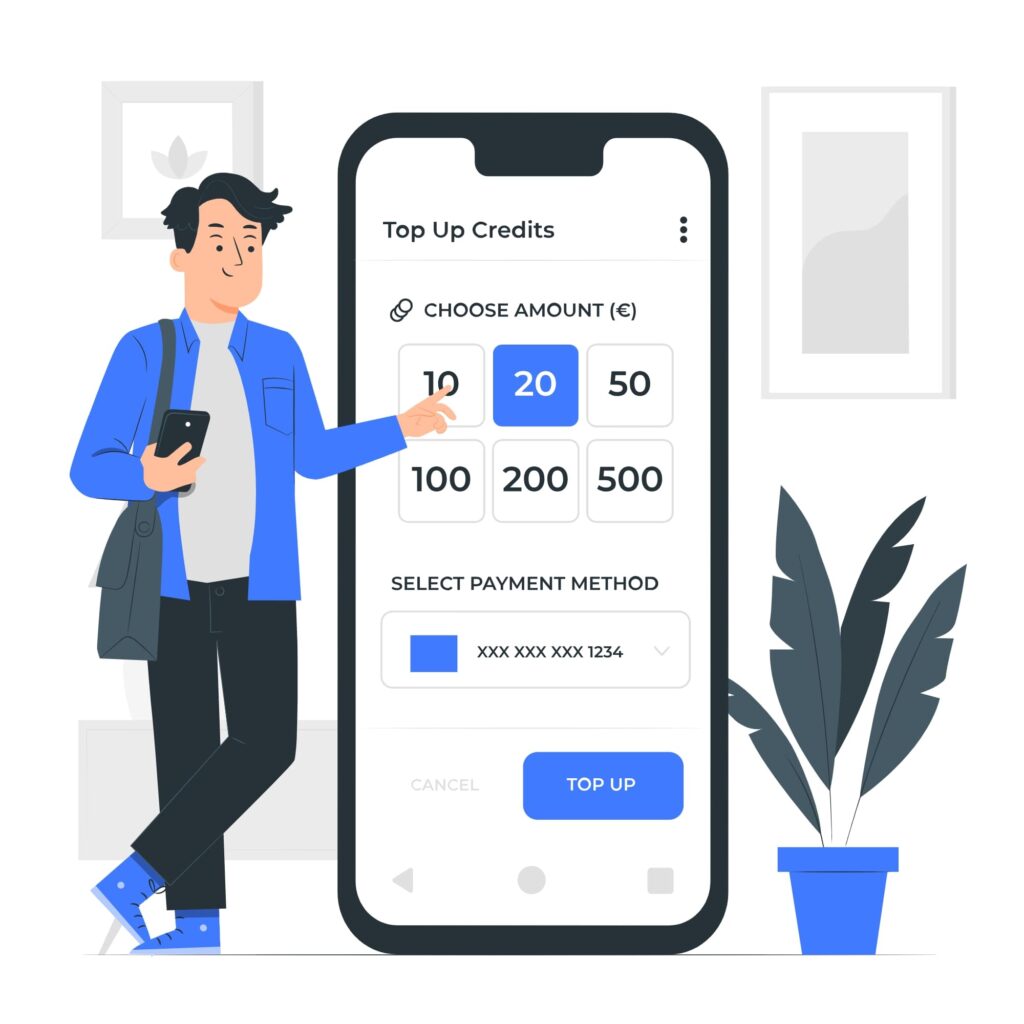

Step 3: Choose a Platform

The platform you choose to invest through can significantly impact your experience. Here are a few factors to consider:

- Fees: Look for platforms with low fees to maximize your investment.

- User Experience: Choose a platform that is easy to navigate.

- Customer Support: Good customer service can help you resolve issues quickly.

- Educational Resources: Some platforms offer educational materials to help you learn about investing.

Several investment platforms and apps cater to beginners with small amounts of money. Here are some top options:

1. Robo-Advisors

Automated platforms like Betterment or Wealthfront manage your investments based on your goals and risk tolerance.

- Pros: Low fees, minimal effort required, diversified portfolios.

- Cons: Limited control over individual investments.

2. Micro-Investing Apps

Apps like Acorns and Stash allow you to invest spare change or small amounts like $5 at a time.

- Pros: User-friendly, low barriers to entry, educational resources.

- Cons: Fees might eat into small investments.

3. Online Brokers

Platforms like Robinhood or Fidelity allow you to invest in individual stocks, ETFs, and more.

- Pros: No commission fees, a wide range of investment options.

- Cons: Requires some investment knowledge.

Step 4: Start Small but Smart

With just $100, you have several investment avenues to explore. Here are some of the most accessible options:

1. Stock Market

Investing in Stocks: Buying shares of companies is one of the most common ways to invest. With $100, you can purchase fractional shares through platforms like Robinhood or M1 Finance.

Example: With $100, you can own 0.25 of a $400 stock.

“Invest in yourself. Your career is the engine of your wealth.” — Paul Clitheroe

2. Exchange-traded funds (ETFs)

ETFs are a collection of stocks bundled together. They offer diversification and are typically less risky than individual stocks. You can start investing in ETFs for as little as $100 on platforms like Vanguard or Charles Schwab.

3. Mutual Funds

While some mutual funds have high minimum investment requirements, many allow you to start with $100. These funds pool money from multiple investors to buy a diversified portfolio of stocks and bonds.

4. Robo-Advisors

Robo-advisors like Betterment or Wealthfront provide automated investment management at a low cost.

You answer a few questions about your risk tolerance and goals, and they create a customized portfolio for you. Many robo-advisors have low minimum investments, making them ideal for beginners.

5. Peer-to-Peer Lending

Platforms like Prosper and LendingClub allow you to lend money to individuals or small businesses in exchange for interest. With $100, you can diversify your investments across multiple loans to mitigate risk.

6. Real Estate Crowdfunding

If real estate interests you but you lack the capital for traditional real estate investing, consider crowdfunding platforms like Fundrise or RealtyMogul. You can invest in real estate projects with as little as $100.

7. High-Interest Savings Accounts

While not technically an investment, placing your money in a high-yield savings account can provide a safe return while you decide where to invest next. It’s a great way to keep your cash accessible.

Step 5: Stay Consistent

“The journey of a thousand miles begins with one step.” – Lao Tzu

Consistency is key to building wealth. Consider the following:

- Dollar-Cost Averaging: Invest a fixed amount regularly to minimize risk.

- Automate Investments: Set up automatic deposits to your investment account.

- Reinvest Returns: Use dividends or profits to buy more shares and grow your portfolio.

1. Dollar-Cost Averaging

This strategy involves investing a fixed amount regularly, regardless of market conditions. By doing so, you can benefit from market fluctuations and reduce the impact of volatility.

2. Diversification

Don’t put all your eggs in one basket. Diversifying your investments across various asset classes can reduce risk and improve returns.

3. Stay Informed

Keep yourself updated on market trends and economic indicators. Knowledge is power in the investment world. Consider subscribing to financial news websites or investing podcasts.

4. Avoid Emotional Investing

Market fluctuations can trigger emotional responses. Stick to your investment strategy and avoid making impulsive decisions based on fear or greed.

How To Build a Habit of Investing:

Many platforms allow you to set up automatic transfers from your bank account to your investment account. This “pay yourself first” strategy helps you build wealth over time without thinking about it.

In addition to automating your investments, set aside a portion of your income each month specifically for investing. This habit can significantly boost your investment portfolio over time.

Regularly review your investments to see how they are performing. Adjust your strategy as needed based on your goals and market conditions.

Investing is not a get-rich-quick scheme. It requires patience and a long-term perspective. The stock market can be volatile, but history shows that it generally trends upward over time.

“Time is your friend; impulse is your enemy.” — John C. Bogle

Overcoming Common Investment Myths

Myth 1: You Need a Lot of Money to Start Investing

As discussed, you can begin investing with just $100. The key is to start, no matter the amount.

Myth 2: Investing is Too Complicated

While investing does require some knowledge, there are plenty of resources available to help you learn. Start with simple investments like ETFs or robo-advisors to build your confidence.

Myth 3: You Must Be a Stock Market Expert

You don’t need to be an expert. Many successful investors rely on sound principles and strategies rather than intricate knowledge of the stock market.

Common Mistakes to Avoid:

- Trying to Time the Market: Focus on time in the market, not timing the market.

- Lack of Diversification: Avoid putting all your eggs in one basket.

- Ignoring Fees: Even small fees can eat into your returns over time.

- Following the Crowd: Stick to your investment plan instead of chasing trends.

Final Thoughts: Take the First Step Today

Starting your investment journey with $100 is a powerful decision. Remember, the key is to start early, stay informed, and remain consistent.

With the right strategies, that $100 could grow into thousands or even millions over time.

Remember, the best time to start investing was yesterday; the second best time is now. Don’t let fear or uncertainty hold you back. Embrace the opportunity to grow your wealth, one dollar at a time!

Don’t wait for the “right” moment; the time to start is now. Begin your journey toward financial independence today!

Recommended Personal Finance Books

1. “The Total Money Makeover” by Dave Ramsey

A practical guide to eliminating debt and building wealth using a step-by-step approach.

Book Buy Link: Amazon Click Here

2. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book provides a holistic approach to achieving financial independence and aligning spending with your values.

3. “Rich Dad Poor Dad” by Robert T. Kiyosaki

A classic that contrasts different mindsets about money and introduces concepts like assets and liabilities.

4. “The Psychology of Money” by Morgan Housel

An insightful read on how emotions and behavior affect financial decisions.

5. “Atomic Habits” by James Clear

While not strictly about finance, this book teaches you how to build habits that can also improve your financial discipline.

6. “I Will Teach You to Be Rich” by Ramit Sethi

A fun, practical guide to managing money, including automation and optimizing spending without guilt.

7. “Financial Freedom” by Grant Sabatier

A step-by-step blueprint to achieving financial independence faster than traditional methods.

Other Interesting Posts To Read:

The 10 Commandments of Long-Term Investing Success

10 Smart Investment Strategies for First-Time Investors

10 Stoic Habits That Can Help & Guide You Toward Financial Independence 🏦

10 Financial Freedom Lessons Men Learn Too Late In Life

5 Smart Budgeting Hacks to Save Big in 2025