Imagine you’re Luffy from One Piece, setting sail on the Grand Line with big dreams of becoming the Pirate King.

You’ve got your crew, your ship, and a burning ambition—but without a map or supplies, you’re just drifting into danger. Investing is a lot like that epic adventure: thrilling, full of treasures, and occasionally stormy seas.

But here’s the good news—no Devil Fruit powers required. As a beginner, you don’t need a treasure chest of cash or a PhD in finance.

You need simple strategies, patience, and a bit of anime-inspired wisdom to navigate it all.

If you’re new to investing, the jargon can feel like deciphering ancient Poneglyphs. Stocks? Bonds? ETFs? It’s overwhelming.

That’s why I’m breaking it down with examples from your favourite anime worlds. We’ll turn Wall Street into the Hidden Leaf Village and compound interest into a Sharingan-level power-up.

By the end, you’ll have a beginner’s playbook to start building wealth, just like how Naruto went from underdog to Hokage. Ready to level up? Let’s dive in.

Why Start Investing Now? Your Ninja Way to Financial Freedom

Before we get started, let’s discuss motivation. Why bother investing when ramen is cheap, and anime marathons are free?

Simple: inflation is the real Akatsuki, silently eroding your savings. That $100 today buys less tomorrow, like how chakra depletes without training.

Enter investing—your Rasengan against poverty. Historical data show the stock market averages 7-10% annual returns after inflation (S&P 500 since 1926).

Start with $1,000 monthly, and in 30 years, you could have crores, thanks to compounding (more on that soon). Anime fans get it: Goku didn’t become a Super Saiyan overnight. Consistent training (investing) builds power.

But beginners fear the “what if I lose it all?” vibe, like Eren Yeager charging into Titan territory blind. Fear not—diversification and long-term thinking turn risks into plot twists you survive.

A 2023 Vanguard study found investors who stayed put through ups and downs beat panickers by 1.5% yearly.

Your first step? Open a brokerage account using platforms like Fidelity, Vanguard, Charles Schwab, or Robinhood—easy to set up online, even for complete beginners.

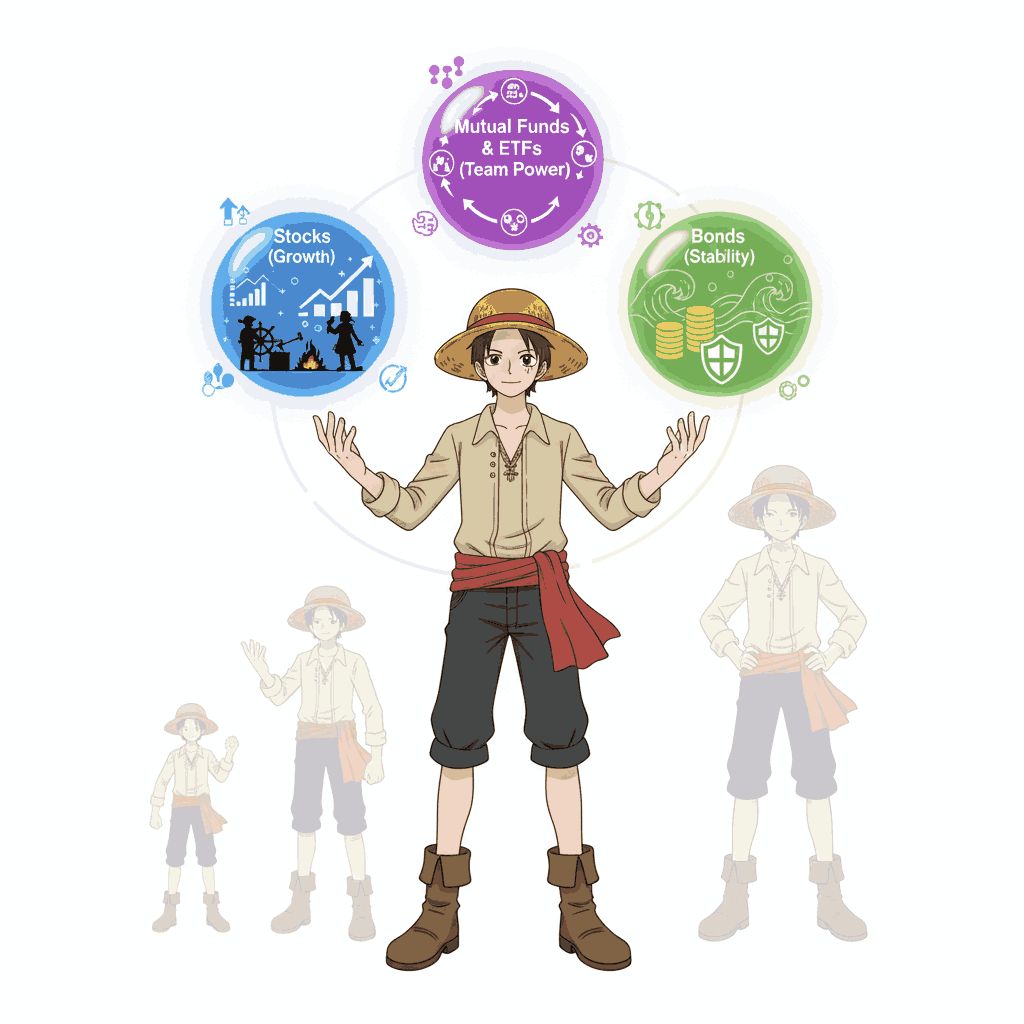

Core Investing Concepts: Anime-Style Breakdown

Let’s demystify the basics. Think of your money as chakra: spend wisely, invest to multiply.

1. Stocks: Own a Piece of the Action Like Luffy’s Crew

Stocks are shares in companies, like recruiting Zoro or Nami to your pirate ship. Buy Apple stock? You’re part-owner, betting on iPhones sailing sales seas.

- Example: In One Piece, Luffy invests in his crew’s skills. Sanji cooks, Usopp invents—each boosts the crew’s treasure haul. Stocks work similarly: buy into Amazon (e-commerce king), and their growth (like Prime deliveries) pads your wallet via rising share prices or dividends (profit shares).

Risk? Volatile, like Grand Line storms. Tesla stock swung 70% in 2022. But long-term? Up 1,000% since 2010. Beginners: Start with blue-chips like Reliance or HDFC Bank—stable giants.

Pro Tip: “Use index funds that track the S&P 500 (America’s top 500 companies). It’s like assembling an all-star team without having to pick individual players.”

Investing in an S&P 500 index fund is like recruiting an entire all-star squad at once—no need to scout each hero individually.”

2. Bonds: The Steady Sanji of Your Portfolio

Bonds are loans to governments or companies. They pay interest, like Sanji’s reliable meals, keeping the crew fed.

- Anime Tie-In: Recall Fullmetal Alchemist‘s State Alchemists on steady payrolls? Bonds are that—low drama, predictable returns (4-7% in India via RBI bonds).

Safe but unsexy: No home runs, but no wipeouts. Perfect for beginners scared of stock seas. Government bonds (G-Secs) are risk-free, backed by India.

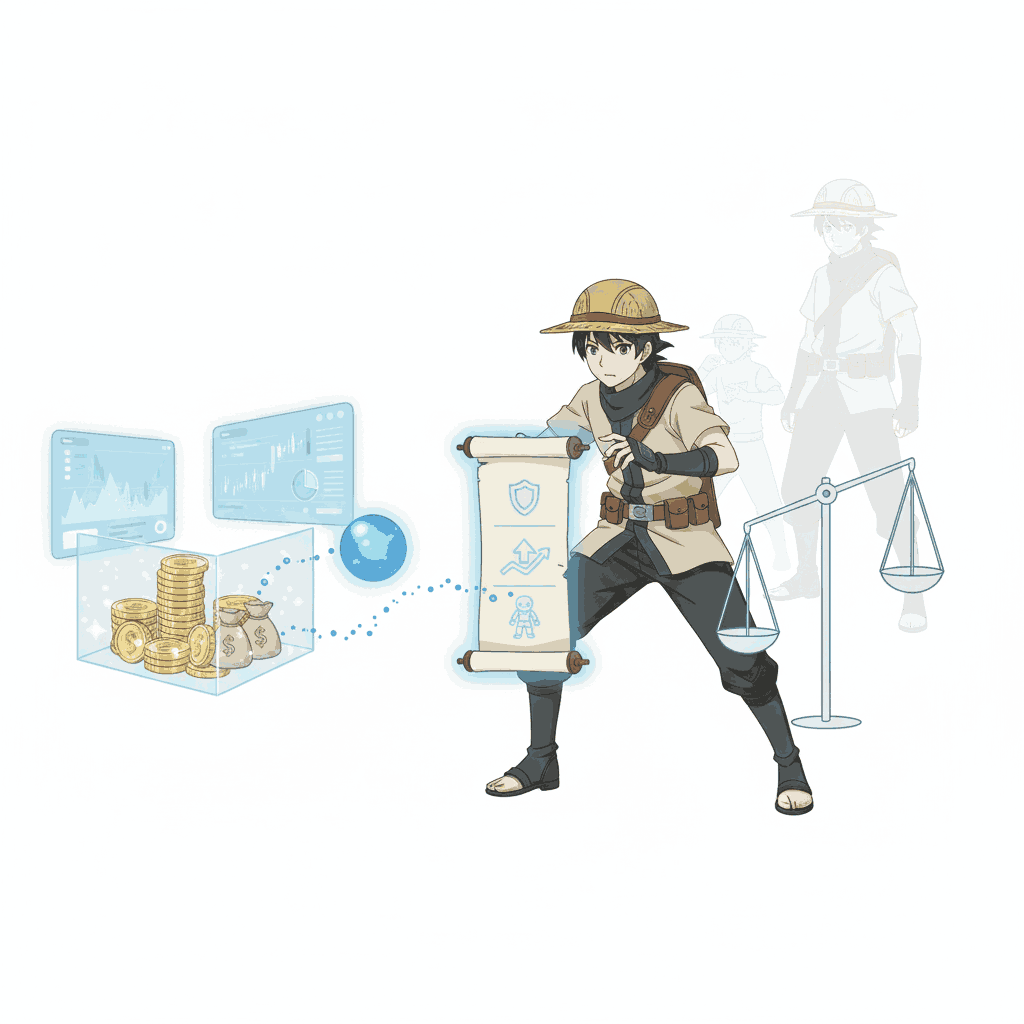

3. Mutual Funds and ETFs: Team-Ups for Epic Wins

Why solo when you can squad up? Mutual funds pool money from many investors, pros manage it. ETFs (Exchange-Traded Funds) are like them but trade like stocks.

- Naruto Parallel: Team 7—Naruto’s grit, Sasuke’s precision, Sakura’s smarts. Mutual funds blend stocks/bonds for balance. Equity funds chase growth; debt funds chill with stability.

In the U.S., you can start investing with as little as $25–$50 per month through automatic investing plans. S&P 500 index funds have historically averaged around 10% annually over the long term. Low-cost ETFs like VOO or SPY track major market indices efficiently and affordably.

The Magic of Compound Interest: One Piece’s Inherited Will

This is investing’s Haki—unseen force multiplying wealth exponentially. Albert Einstein called it the “eighth wonder.”

Formula: A=P(1+r/n)nt, where A is future value, P principal, r rate, n compounds/year, t time.

Simple example: $1,200 invested at 10% annually (compounded):

If you want it to sound a bit more storytelling / anime-style, you can also use:

Imagine starting with $1,200 and letting it grow at 10% per year—like a hero training quietly over time.

Growth Example (in USD)

- After 1 year: ~$1,325

- After 10 years: ~$3,120

- After 30 years: ~$21,020

This shows how steady, long-term investing can turn a modest starting amount into meaningful wealth over time—especially when compound growth is allowed to work uninterrupted.

Anime magic? Luffy’s Gear Second accelerates speed; compounding accelerates money. Start early—like Ash Ketchum at 10—and watch it snowball.

Real-World Hack: Apps like ET Money automate SIPs. Miss it? You’re missing Conqueror’s Haki potential.

Risk Management: Don’t Get Titan-Eaten

Every shonen hero faces villains. Investing’s foes: volatility, emotions, scams.

Volatility: Market’s Wild Storms

Stocks dip 10-20% yearly, like Attack on Titan‘s walls crumbling. 2008 crash? S&P fell 50%. But it rebounded 400% since.

Strategy: Dollar-Cost Averaging (DCA). Invest fixed amounts regularly, buying more cheap shares. Luffy buys low after shipwrecks, sails high later.

Emotions: The Inner Demon

Fear sells out (2008 panic), greed buys high (2021 meme frenzy). Be like Levi Ackerman: calm, calculated.

Rule: Ignore headlines. Invest for 10+ years. A Fidelity study: Best performers forgot accounts existed.

Diversification: Your Survey Corps

Don’t all-in on one stock (bye, FTX crash). Spread across assets:

| Asset Type | Risk Level | Anime Example | Expected Return | Best For |

|---|---|---|---|---|

| Stocks | High | Luffy’s adventures | 10-12% | Growth seekers |

| Bonds | Low | Sanji’s cooking | 5-7% | Safety first |

| Gold | Medium | Colossal Titan hoard | 8-10% | Inflation hedge |

| Real Estate | Medium-High | Hidden Leaf properties | 7-9% | Long-term builds |

| Crypto | Very High | Devil Fruits | Volatile (20%+ or bust) | Risk lovers |

Aim for 60% stocks, 30% bonds, 10% alternatives at start (age-based: subtract age from 100 for stock %).

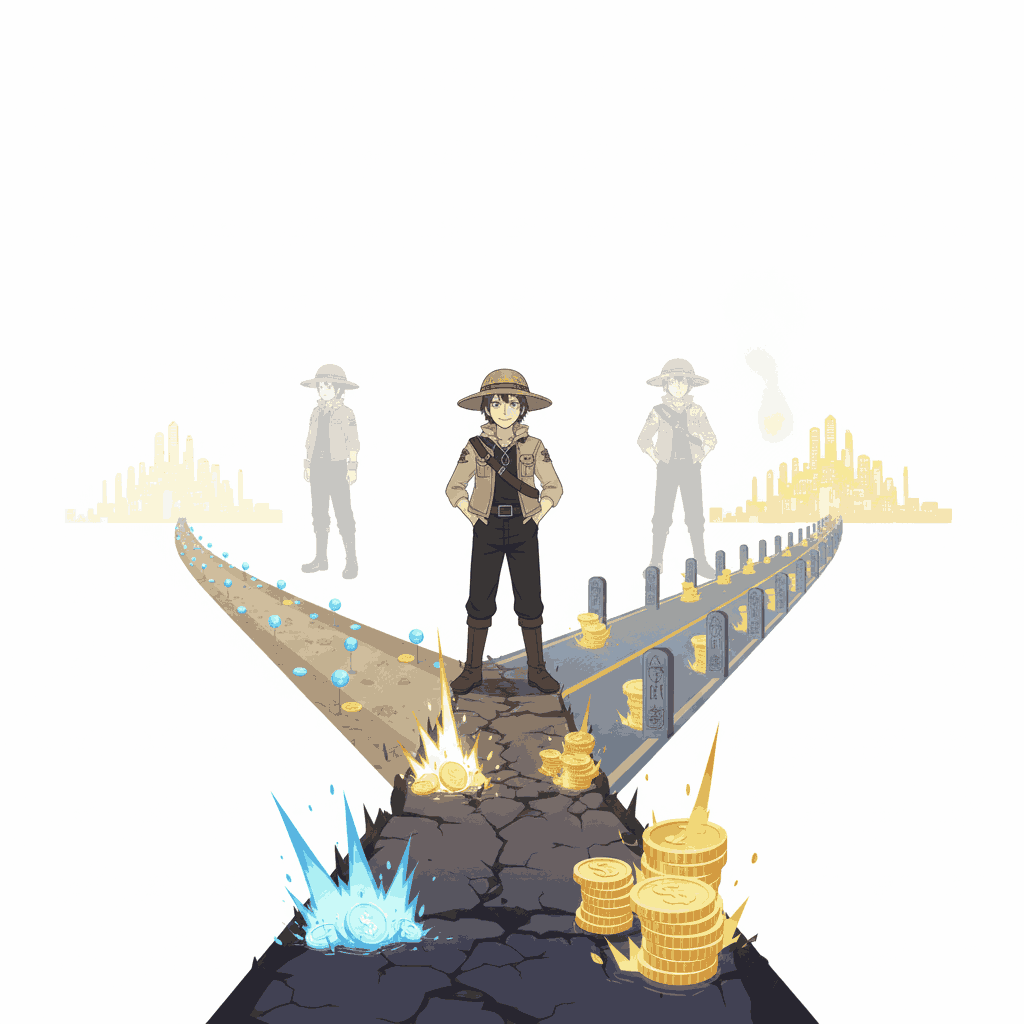

Building Your Portfolio: Step-by-Step Ninja Guide

Time to assemble, genin-style.

Step 1: Set Goals (Your Nindo)

Fitness? Emergency fund first (6 months’ expenses in liquid savings). Retirement? Long-term growth. Anime habit? Side fund for merch.

Tool: Use Groww’s goal planner—visual like Hunter x Hunter‘s Nen system.

Step 2: Emergency Fund (Ramen Reserve)

3-6 months living costs in savings/FDs. Like Ichigo’s Bankai reserve—no touching for impulses.

Step 3: Choose Accounts and Brokers

For beginners in the U.S., popular platforms include Fidelity, Vanguard, Charles Schwab, and Robinhood. If you’re investing internationally, Interactive Brokers is a strong global option. You can track your portfolio using apps like Yahoo Finance or Morningstar.

Step 4: Start Small with SIPs

Even $25 a month invested into an S&P 500 index ETF can quietly grow in the background—while the app takes care of the work for you.

Step 5: Rebalance Yearly

Like team training—trim winners, boost laggards.

Sample Beginner Portfolio ($10,000)

- 50% S&P 500 Index ETF ($5,000) – Long-term growth

- 30% Bond Fund ($3,000) – Stability and income

- 10% Gold ETF ($1,000) – Hedge against inflation

- 10% International Stock ETF ($1,000) – Global exposure

Expected long-term return: ~8–10% annually with relatively low risk for beginners.

Advanced Beginner Tips: Unlock Sharingan Insights

Tax Smarts: The U.S. Jutsu

- Long-term investments (held over 1 year): Profits are taxed at long-term capital gains rates—typically 0%, 15%, or 20%, depending on your income level.

- Short-term investments (held under 1 year): Gains are taxed as ordinary income, based on your federal tax bracket.

- Tax-advantaged accounts: Investing through 401(k)s, IRAs, or Roth IRAs can significantly reduce or even eliminate taxes on your investment growth.

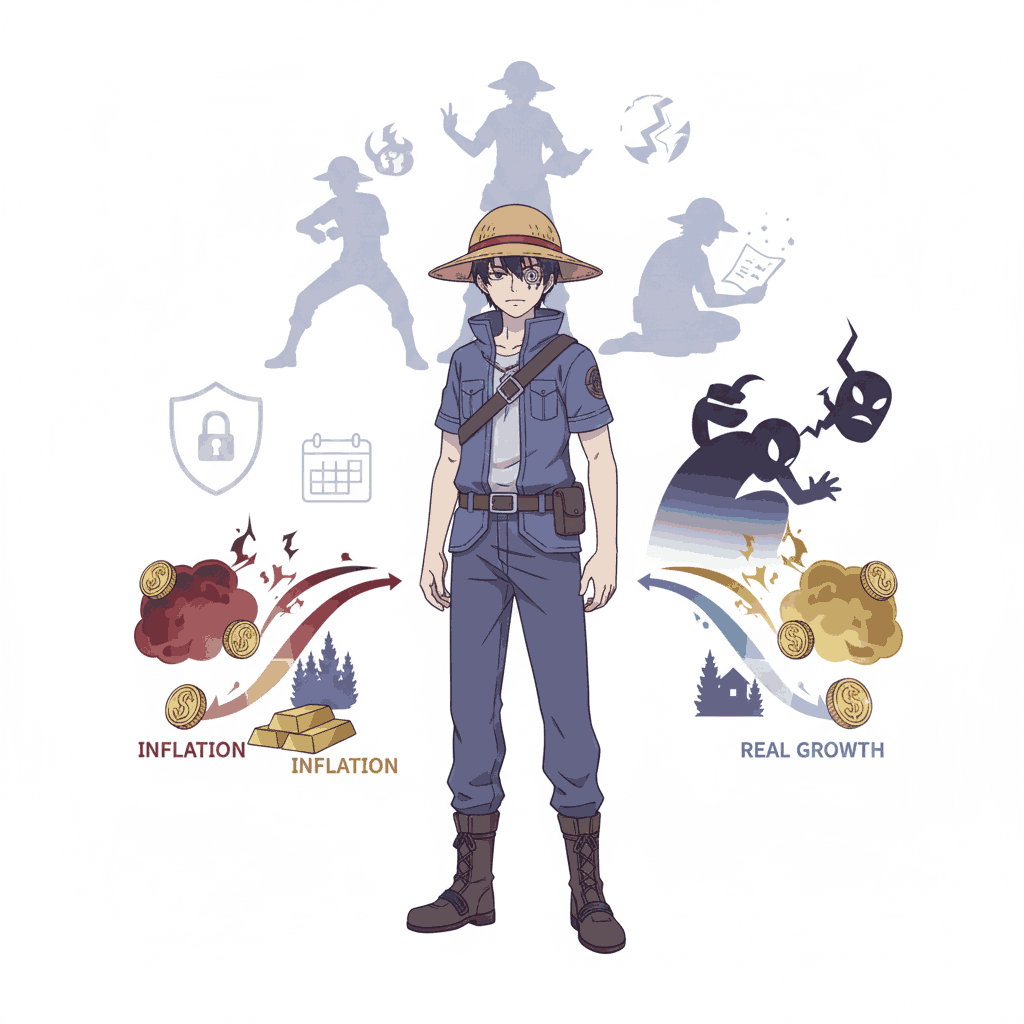

Inflation Beater: Real Returns

Nominal 10% minus 6% inflation = 4% real growth. Gold/real estate hedge it.

Anime-Inspired Habits

- Goku Mindset: Train daily (SIP every payday).

- Jiraiya Wisdom: Learn via books (Rich Dad Poor Dad, The Intelligent Investor—affiliate recs).

- Vegeta Pride: Track net worth monthly (Excel or Kuvera app).

Common Mistakes: Villains to Dodge

- Timing the Market: Pros fail 80% time. Time in market wins.

- Chasing Hot Tips: Meme stocks = Geass curses (Code Geass).

- Ignoring Fees: 1% expense ratio eats 25% returns over 30 years.

- Panic Selling: 2020 COVID dip? Buyers doubled their money by 2021.

Real Success Stories: Heroes Who Levelled Up

Warren Buffett: Started investing as a teenager and quietly compounded wealth for decades—eventually building a net worth in the hundreds of billions.

His success came from patience and long-term thinking, much like an anime series that takes hundreds of episodes to reach its peak.

Reddit’s “Roaring Kitty”: Turned about $53,000 into nearly $50 million during the GameStop frenzy—then lost a large portion when hype faded.

Lesson: Speculation and “YOLO trades” can create dramatic moments, but they’re rarely sustainable strategies.

Your story: A 25-year-old investing $150–$200 per month consistently at an average 10–12% annual return could grow their portfolio into seven figures by retirement—without drama, hype, or stress.

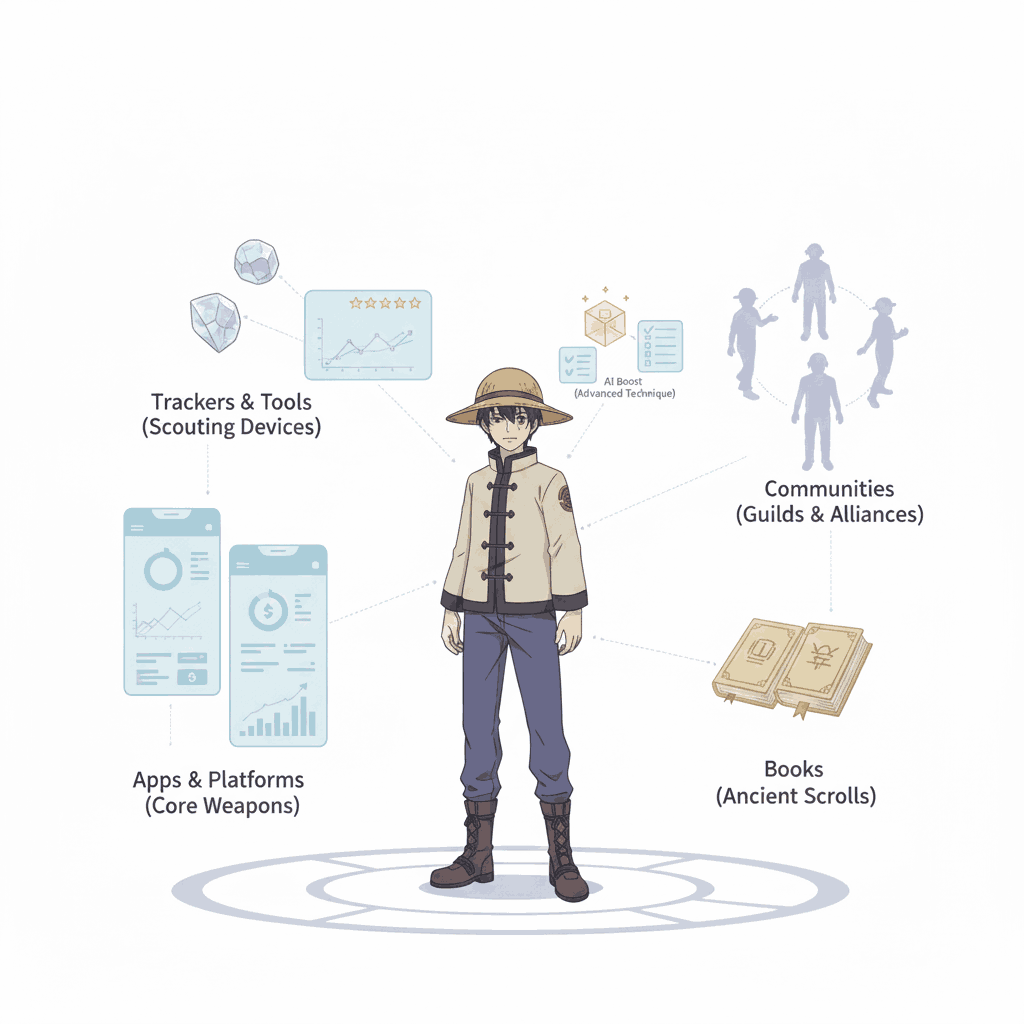

Tools and Resources: Your Dojo Arsenal

Apps & Platforms:

- Fidelity, Vanguard, Charles Schwab, Robinhood (easy-to-use investing apps)

- Free learning resources from Vanguard Education or Fidelity Learning Center

Trackers & Tools:

- Yahoo Finance

- Morningstar

- Google Finance

Communities:

- r/investing and r/personalfinance on Reddit

- Bogleheads.org (long-term, index-focused investors)

Books:

- “The Simple Path to Wealth” by JL Collins

- “The Little Book of Common Sense Investing” by John C. Bogle

AI Boost:

- Use ChatGPT to summarize earnings reports, understand financial ratios, or create simple stock-analysis checklists—perfect for streamlining your investing workflow.

Final Power-Up: Start Today

Investing isn’t just for Wall Street tycoons—it’s for dreamers like you, chasing your own Hokage-level status in finance.

Start small with an automatic $25–$50 monthly investment, learn as you go, and let compound growth work its quiet One Piece–style magic over time.

Ignore the noise. Stay disciplined. Diversify wisely.

And before you realize it, you’ll be the captain of your own financial crew, steering your wealth with confidence instead of fear.

Disclosure: This content is for educational purposes only and is not financial advice. Always consider consulting a qualified financial advisor. Past performance does not guarantee future results. Invest at your own risk.

Other Interesting Posts To Read:

Create Your Financial Anime Arc: Planning Money Milestones Like a Series

Power-Up Your Wealth Tree: Growth Investing with Anime Tropes

Stock Market Saga: Investing Lessons from Epic Anime Journeys

Upgrade Your Money Mana: Skills Every Anime Fan Should Know for Smart Spending

Financial Villains to Watch: Anime-Style Analogy for Hidden Money Traps