Know The Top 10 Financial Habits of Millionaires and how to apply these strategies to your own life. From budgeting wisely to building multiple income streams, unlock the secrets to financial success today!

In a world where wealth can seem elusive, the financial habits of millionaires offer a roadmap to success. While many dream of becoming millionaires, few understand the daily practices and mindsets that can make that dream a reality.

Have you ever wondered how millionaires build and sustain their wealth? While luck or inheritance might play a role for some, most self-made millionaires have succeeded through disciplined financial habits.

The good news is, you don’t have to be a millionaire to adopt these habits. By integrating these proven strategies into your life, you can set yourself on the path to financial independence.

As Warren Buffet aptly said, “Do not save what is left after spending, but spend what is left after saving.” This mindset reflects one of the core principles shared by the wealthy: intentional financial management.

In this blog, we will explore the financial habits of millionaires that you can adopt today. From strategic investing to smart spending, these practices can transform your relationship with money.

So, let’s dive in and uncover the secrets to building wealth.

Understanding Millionaires: Who Are They?

Before we explore the habits of millionaires, it’s essential to define who these individuals are. According to a 2023 report by Credit Suisse, there are over 56 million millionaires worldwide.

These individuals range from entrepreneurs to corporate executives, but they all share common financial habits that set them apart from the average person.

“Wealth is not about having a lot of money; it’s about having a lot of options.” – Chris Rock

This quote perfectly encapsulates the essence of wealth. Millionaires enjoy financial freedom, which allows them to make choices that enrich their lives.

But how do they get there? Let’s break down the key financial habits that can guide anyone toward financial success.

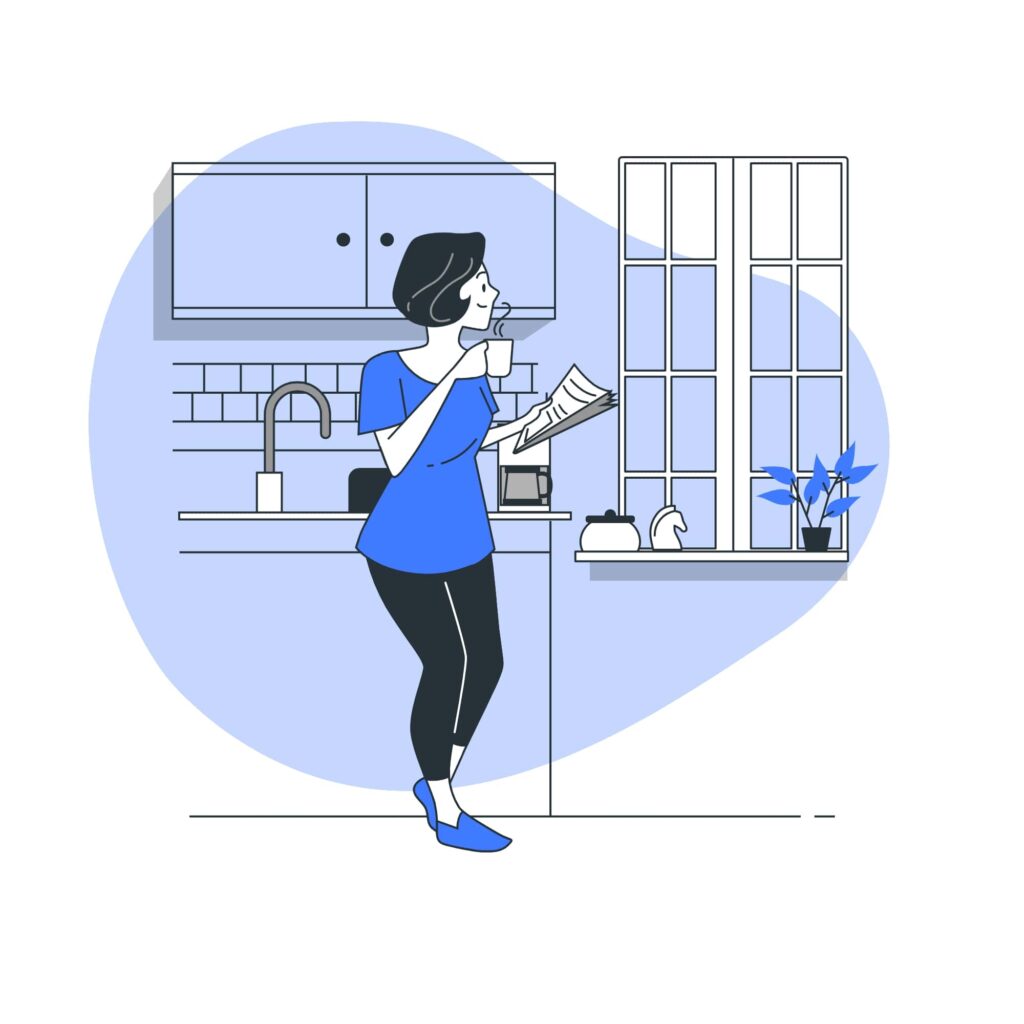

1. They Set Clear Financial Goals:

Define short-term, medium-term, and long-term financial goals. For example, saving $5,000 for emergencies, investing $50,000 in a diversified portfolio, or retiring with $2 million by age 60.

Millionaires don’t stumble upon wealth; they plan for it. Goal-setting is a foundational habit that keeps their financial journey on track.

Clear financial goals serve as a roadmap, helping them navigate decisions and measure progress effectively.

Why Goal-Setting Matters:

- Provides Direction: Setting goals clarifies what you are working towards, whether it’s early retirement, purchasing a home, or building a robust investment portfolio.

- Enhances Motivation: Tangible goals act as a motivator, keeping you focused and resilient in the face of challenges.

- Enables Better Decision-Making: When you have clear objectives, it’s easier to prioritize spending, saving, and investing decisions.

Types of Financial Goals:

- Short-Term Goals: These are goals you aim to achieve within a year or two. Examples include saving for a vacation, building an emergency fund, or paying off credit card debt.

- Medium-Term Goals: These typically span three to five years. Examples include saving for a down payment on a home, paying off student loans, or purchasing a car.

- Long-Term Goals: These goals often extend beyond five years and include retirement savings, funding your children’s education, or achieving financial independence.

How Millionaires Approach Goal-Setting:

- SMART Goals: Millionaires set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

- Example: Instead of saying, “I want to save more money,” they define, “I will save $10,000 for emergencies within 12 months by saving $833 per month.”

- Regular Review and Adjustment: They frequently review their financial goals and make adjustments based on changes in income, expenses, or priorities.

- Visualization: Many millionaires use visualization techniques to imagine achieving their goals, reinforcing their commitment to the process.

How You Can Start:

- Write down your financial goals and categorize them into short-term, medium-term, and long-term.

- Break each goal into smaller, actionable steps. For instance, if your goal is to save $5,000 in a year, commit to saving approximately $417 per month.

- Track your progress regularly and celebrate small milestones to stay motivated.

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

2. They Live Below Their Means:

Living below their means is a cornerstone of financial success for millionaires.

Contrary to popular belief, most wealthy individuals are not frivolous spenders; they are intentional about their spending and prioritize financial security over flashy lifestyles.

This habit allows them to save and invest more, accelerating their journey to wealth.

Why Living Below Your Means Matters:

- Builds a Financial Cushion: Spending less than you earn helps you save for emergencies and unexpected expenses, reducing financial stress.

- Frees Up Money for Investments: By minimizing discretionary spending, you can allocate more funds to investments, which are essential for growing wealth.

- Encourages Financial Discipline: Adopting a frugal mindset fosters better money management and long-term financial stability.

How Millionaires Practice This Habit:

- Prioritizing Value Over Luxury: Millionaires often focus on the utility and value of items rather than their brand or status. For instance, they might drive reliable, moderately-priced cars instead of luxury vehicles.

- Avoiding Lifestyle Inflation: As their income increases, they resist the temptation to upgrade their lifestyle unnecessarily. Instead, they maintain their current standard of living and invest the surplus income.

- Budgeting and Tracking Expenses: Many millionaires create detailed budgets and track their spending to ensure they stay within their means. Tools like Mint, YNAB (You Need a Budget), or even simple spreadsheets help them monitor cash flow effectively.

- Negotiating and Finding Deals: Whether it’s negotiating the price of a car or shopping during sales, millionaires often look for ways to get the best value for their money.

- Avoiding Debt for Consumption: They steer clear of taking on debt for non-essential purchases, such as vacations or luxury goods. If they use credit cards, they pay off the balance in full each month to avoid interest charges.

Practical Steps You Can Take:

- Create a Realistic Budget: Assess your income and categorize your expenses into essentials, savings, and discretionary spending. Stick to this budget consistently.

- Embrace Minimalism: Focus on buying items that truly add value to your life. Avoid impulse purchases and practice mindful spending.

- Automate Savings: Set up automatic transfers to your savings or investment accounts before you start spending.

- Evaluate Your Lifestyle Choices: Regularly review your expenses to identify areas where you can cut back without sacrificing quality of life.

Real-Life Example:

Consider the habits of self-made millionaire David Bach, author of “The Automatic Millionaire.” He emphasizes the importance of avoiding the “Latte Factor,” a term he coined to describe how small, unnecessary daily expenses (like a $5 latte) can add up over time. Instead, he advocates redirecting these funds toward savings or investments.

“If you buy things you do not need, soon you will have to sell things you need.” – Warren Buffet

3. They Pay Themselves First:

The phrase “pay yourself first” is a foundational principle in personal finance that emphasizes the importance of prioritizing your savings and investments before addressing other expenses.

This habit is commonly practiced by millionaires and serves as a powerful strategy for building wealth.

Here’s a detailed breakdown of what it means, why it’s important, and how you can implement it in your own life.

What Does “Pay Yourself First” Mean?

“Paying yourself first” involves setting aside a predetermined amount of your income for savings and investments before you allocate money for bills, groceries, and discretionary spending.

Instead of considering savings as what’s left over after expenses, you treat it as a non-negotiable expense.

Why Is It Important?

- Establishes a Savings Habit: By automatically setting aside money for savings, you create a consistent habit. This can help reinforce the idea that saving is essential, rather than optional.

- Prioritizes Financial Goals: Paying yourself first ensures that you are actively working towards your financial goals, whether they involve retirement savings, an emergency fund, or investment accounts.

- Reduces the Temptation to Spend: When you allocate funds for savings before spending, you are less likely to view those funds as available for discretionary spending. This helps curb impulsive purchases and promotes more mindful spending.

- Benefits from Compound Interest: The sooner you save and invest your money, the more time it has to grow through compound interest. This exponential growth is crucial for wealth accumulation.

How to Implement “Pay Yourself First”

1. Set a Savings Goal: Determine how much you want to save. A common recommendation is to save at least 20% of your income, but you can adjust this based on your financial situation.

2. Automate Your Savings: Set up automatic transfers to your savings or investment accounts. This can be done through your bank or employer via direct deposit. Automating your savings makes it easier to stick to your plan.

3. Create a Budget: Develop a budget that reflects your income, expenses, and savings goals. By organizing your finances, you can easily identify how much you can afford to pay yourself first.

4. Prioritize Savings Accounts: Consider opening multiple savings accounts for different goals. For example, you might have one account for an emergency fund, another for retirement, and another for a future purchase.

5. Review and Adjust: Regularly assess your financial situation and adjust your savings contributions as necessary. Life changes, such as a new job or significant expenses, may require you to reevaluate your savings strategy.

Real-Life Example

Imagine you earn $3,000 a month. If you adopt the “pay yourself first” principle, you might decide to save 20%, or $600, before spending on anything else. You automate this transfer to a savings account on payday. Now, you have $2,400 left for your expenses.

This method not only helps you build a robust savings account but also keeps you disciplined about your spending. Over time, those savings can grow significantly, especially if you invest them wisely.

“Do not save what is left after spending; instead, spend what is left after saving.” – Warren Buffet

4. They Invest Wisely:

Investing wisely is one of the most critical habits that distinguish millionaires from the average person. While many people save, not everyone knows how to invest effectively.

For millionaires, smart investing is a key strategy for wealth accumulation and financial security.

Millionaires understand the power of compound interest and leverage it by investing early and consistently. They diversify their portfolios to minimize risk and maximize returns.

Investing wisely involves making informed, strategic decisions about where to allocate your money to generate the best returns over time.

This can include a variety of investment vehicles, such as stocks, bonds, real estate, mutual funds, and more. The focus is on achieving long-term growth rather than seeking quick profits.

Why Is Wise Investing Important?

- Wealth Accumulation: Investing allows your money to grow over time through compound interest and capital appreciation. This is essential for building wealth that can support your financial goals.

- Inflation Hedge: Money that sits in a savings account can lose value over time due to inflation. Investing helps protect your purchasing power by growing your wealth at a rate that outpaces inflation.

- Financial Independence: A well-crafted investment portfolio can provide passive income and financial freedom, allowing you to retire comfortably or pursue other interests without the stress of financial constraints.

- Diversification: Wise investing encourages diversification, which spreads risk across different asset classes. This can help mitigate losses during market downturns.

Strategies for Wise Investing:

1. Educate Yourself: Knowledge is power in investing. Take the time to understand different asset classes, market trends, and investment strategies. Consider reading books, attending seminars, or taking online courses.

2. Set Clear Goals: Define your investment goals based on your financial situation, risk tolerance, and time horizon. Are you saving for retirement, a home, or your child’s education? Your goals will guide your investment strategy.

3. Create a Diversified Portfolio: Diversification is key to reducing risk. Include a mix of asset classes such as stocks, bonds, real estate, and cash. This way, if one investment performs poorly, others may perform better, balancing your overall returns.

4. Invest for the Long Term: Millionaires understand the power of long-term investing. Avoid the temptation to react to short-term market fluctuations. Instead, focus on the bigger picture and remain committed to your investment strategy.

5. Regularly Review Your Portfolio: Periodically assess your investment portfolio to ensure it aligns with your goals and risk tolerance. Rebalance your portfolio if necessary to maintain your desired asset allocation.

6. Utilize Tax-Advantaged Accounts: Take advantage of tax-deferred or tax-free investment accounts, such as 401(k)s or IRAs. These accounts can help you maximize your returns by minimizing tax liabilities.

7. Consider Professional Advice: If you’re unsure about where to start or how to manage your investments, consider consulting a financial advisor. They can help you develop a tailored investment strategy based on your circumstances.

Common Investment Vehicles:

- Stocks: Owning shares in a company can provide significant long-term growth potential. Stocks can be volatile, but they historically offer higher returns compared to other investments.

- Bonds: Bonds are generally considered safer investments. They provide fixed interest payments and return the principal at maturity. Including bonds in your portfolio can help balance the risk of stocks.

- Mutual Funds and ETFs: These pooled investment vehicles allow you to invest in a diversified portfolio of stocks and bonds. They can be a good option for those who prefer a hands-off approach.

- Real Estate: Investing in real estate can provide rental income and potential appreciation. Real estate often acts as a hedge against inflation and can diversify your investment portfolio.

- Index Funds: These funds track a specific market index and offer broad market exposure with lower fees. They are an excellent option for passive investors looking for long-term growth.

Real-Life Example

Consider the investment strategy of renowned investor Warren Buffett. He is known for his long-term approach, focusing on companies with strong fundamentals and solid growth potential.

Buffett often emphasizes the importance of understanding the businesses you invest in, so you can hold them for the long term without panic during market volatility.

For instance, Buffett famously invested in Coca-Cola in 1988. He recognized its strong brand and consistent performance.

Even when the market fluctuated, he held onto his shares, resulting in substantial returns over the years.

What You Can Do:

- Start investing as soon as possible, even with small amounts.

- Diversify your investments across stocks, bonds, real estate, and mutual funds.

- Educate yourself on investment options or consult a financial advisor.

Fun Fact: The average millionaire allocates at least 20% of their income toward investments.

5. They Avoid Bad Debt:

Avoiding bad debt is a hallmark of the financial habits of millionaires. While debt can sometimes be a useful tool for building wealth, not all debt is created equal.

Millionaires understand the distinction between good debt and bad debt, and they make it a priority to steer clear of the latter.

Here’s a detailed exploration of what it means to avoid bad debt, why it’s essential, and how you can apply this principle in your financial life.

What Is Bad Debt?

Bad debt refers to borrowing that does not contribute to wealth-building and often leads to financial strain.

This type of debt typically has high interest rates and is used to purchase depreciating assets or non-essential items. Common examples of bad debt include:

- Credit Card Debt: Accumulating charges on credit cards with high interest rates for everyday expenses or luxury items.

- Personal Loans: Borrowing money for non-essential purchases that do not generate income.

- Car Loans: Financing vehicles that depreciate quickly, especially if the purchase is beyond a reasonable budget.

- Payday Loans: Short-term, high-interest loans that can create a cycle of debt.

Why Is Avoiding Bad Debt Important?

- Financial Freedom: Bad debt can create a significant financial burden, hindering your ability to save and invest. By avoiding it, you free up more of your income for savings and wealth-building activities.

- Reduced Stress: Carrying debt can lead to anxiety and stress. Avoiding bad debt allows for greater peace of mind and financial security.

- Better Credit Score: High levels of bad debt can negatively impact your credit score. Maintaining a healthy credit profile is essential for securing favorable loan terms in the future.

- Increased Savings Potential: Without the weight of bad debt, you have more disposable income available to allocate toward savings, investments, and other wealth-building opportunities.

How to Avoid Bad Debt:

1. Create a Budget: Establishing a budget is the first step in understanding your income and expenses. This allows you to see where your money is going and helps you avoid overspending.

2. Live Within Your Means: Commit to spending less than you earn. This principle is vital for avoiding unnecessary debt. Focus on needs versus wants and make conscious spending decisions.

3. Use Credit Wisely: If you use credit cards, aim to pay off the balance in full each month to avoid interest charges. Treat credit as a convenience rather than a way to finance your lifestyle.

4. Build an Emergency Fund: Having a financial cushion can prevent you from relying on credit cards or loans in case of unexpected expenses. Aim for three to six months’ worth of living expenses saved in a liquid account.

5. Evaluate Purchases Carefully: Before making a significant purchase, ask yourself whether it’s a need or a want. Consider whether the item will appreciate or contribute to your financial goals.

6. Avoid Lifestyle Inflation: As your income increases, avoid the temptation to increase your spending correspondingly. Instead, prioritize saving and investing the additional income.

7. Seek Alternatives to High-Interest Loans: If you find yourself in need of funds, explore lower-interest options, such as personal loans from credit unions or borrowing from family or friends.

Real-Life Example:

Consider the story of a young professional who receives a significant salary increase. Instead of rushing to buy a new luxury car and accruing a large car loan, she opts for a reliable used car that fits her budget.

She uses the money saved to create an emergency fund and invest in a retirement account.

By avoiding bad debt, she sets herself up for long-term financial success while maintaining a comfortable lifestyle.

Understanding Good Debt vs. Bad Debt

To further clarify the concept, it’s essential to understand the difference between good debt and bad debt:

- Good Debt: This type of debt is typically an investment that has the potential to increase in value or generate income. Examples include:

- Mortgages: Buying a home can be considered good debt, especially if the property appreciates over time.

- Student Loans: Investing in education can lead to higher earning potential in the future.

- Business Loans: Financing a business that has the potential for growth and profitability.

- Bad Debt: As previously mentioned, this involves borrowing for depreciating assets or unnecessary expenses. It can lead to financial distress and limit your ability to build wealth.

While millionaires may use debt strategically (e.g., for real estate investments), they steer clear of high-interest consumer debt such as credit card balances.

Steps to Follow:

- Pay off high-interest debts as quickly as possible.

- Use credit cards responsibly, paying off the balance in full each month.

- Build an emergency fund to avoid relying on debt in tough times.

Pro Tip: Use tools like the debt snowball or avalanche method to eliminate debt effectively.

Avoiding bad debt is a fundamental habit that can significantly impact your financial health and overall well-being.

By making informed borrowing decisions and prioritizing financial discipline, you can create a solid foundation for wealth accumulation.

Focus on living within your means, budgeting wisely, and seeking opportunities that enhance your financial future.

6. They Continuously Educate Themselves:

Self-made millionaires are lifelong learners. They constantly seek knowledge to improve their financial acumen and make informed decisions.

Continuous education is one of the hallmarks of successful millionaires. In a rapidly changing financial landscape, staying informed and adaptable is crucial for making smart decisions.

This commitment to lifelong learning not only helps millionaires navigate complex financial markets but also empowers them to seize opportunities and mitigate risks.

Here’s a detailed exploration of what it means to continuously educate oneself, why it matters, and how you can adopt this habit in your own life.

What Does Continuous Education Mean?

Continuous education refers to the ongoing pursuit of knowledge and skills throughout an individual’s life.

For millionaires, this often involves actively seeking out new information related to finance, investing, business, and personal development. This can take various forms, including:

- Reading Books: Engaging with literature that covers financial principles, investment strategies, and personal development.

- Taking Courses: Enrolling in online or in-person courses that provide structured learning on specific topics.

- Attending Seminars and Workshops: Participating in events that offer insights from experts and networking opportunities.

- Listening to Podcasts and Watch Webinars: Consuming information in formats that fit into busy schedules.

- Networking with Peers: Engaging in discussions with other successful individuals to exchange ideas and strategies.

Why Is Continuous Education Important?

- Staying Informed: Financial markets, economic conditions, and investment opportunities are constantly evolving. Continuous education helps you stay updated on trends and changes that could impact your financial decisions.

- Improving Decision-Making: A deeper understanding of financial concepts and market dynamics leads to better decision-making. Educated investors are more likely to avoid pitfalls and capitalize on opportunities.

- Adapting to Change: The ability to learn and adapt is crucial in today’s fast-paced world. Continuous education equips you with the skills needed to pivot strategies and embrace new technologies or methodologies.

- Enhancing Skills: Lifelong learning helps you develop both hard and soft skills that can enhance your career prospects and personal growth. This can lead to better job performance, promotions, and entrepreneurial success.

- Building Confidence: Knowledge breeds confidence. The more you know, the more secure you feel in making financial decisions, whether it’s investing in the stock market or starting a business.

How to Embrace Continuous Education:

1. Set Learning Goals: Identify specific areas you want to improve or learn more about. This could be understanding investment strategies, mastering personal finance, or enhancing your professional skills.

2. Create a Reading List: Compile a list of books, articles, and financial literature to read regularly. Consider classics like “The Intelligent Investor” by Benjamin Graham or “Rich Dad Poor Dad” by Robert Kiyosaki.

3. Enroll in Courses: Explore online platforms like Coursera, Udemy, or Khan Academy to find courses relevant to your interests. Many universities also offer free or low-cost online courses.

4. Attend Workshops and Seminars: Look for local or virtual events hosted by financial experts or business leaders. These can provide valuable insights and networking opportunities.

5. Listen to Podcasts: Find podcasts that focus on finance, investing, and personal development. Listening during your commute or while exercising can help you absorb information efficiently.

6. Join Professional Associations: Becoming a member of relevant professional organizations can provide access to resources, events, and networking opportunities that facilitate learning.

7. Network with Like-Minded Individuals: Surround yourself with people who value education and personal growth. Engaging in discussions with peers can enhance your understanding and expose you to new ideas.

Real-Life Example:

Consider the example of Ray Dalio, the founder of Bridgewater Associates, one of the world’s largest hedge funds.

Dalio emphasizes the importance of continuous learning and reflection. He famously maintains a practice of documenting his experiences and lessons learned, which he shares through his book “Principles.”

Dalio’s commitment to education has not only contributed to his success but also influenced others in the finance community.

Tools for Continuous Education:

- Online Learning Platforms: Websites like Coursera, Udemy, and LinkedIn Learning offer courses on a wide range of topics, often taught by industry experts.

- Book Recommendations: Create a personal library of financial and self-improvement books. Titles like “The Millionaire Next Door” by Thomas J. Stanley and “Atomic Habits” by James Clear provide valuable insights.

- Podcasts and Audiobooks: Utilize apps like Spotify or Audible to access informative content on the go.

- Webinars and Online Conferences: Participate in live events that focus on current financial trends or investment strategies.

Ways to Educate Yourself:

- Read personal finance books like “The Millionaire Next Door” or “Rich Dad Poor Dad”.

- Follow reputable financial blogs, podcasts, or YouTube channels.

- Take online courses on investing, budgeting, and wealth management.

“The more you learn, the more you earn.” – Warren Buffet

The habit of continuous education is essential for anyone seeking to achieve financial success.

By dedicating time and resources to learning, you can enhance your knowledge, improve decision-making, and adapt to an ever-changing environment.

7. They Build Multiple Streams of Income:

One key habit of millionaires is diversifying their income sources. Relying solely on a single paycheck is risky, so they create additional streams of revenue.

Building multiple streams of income is a fundamental principle among millionaires and financially successful individuals.

This strategy involves creating various sources of income beyond a single paycheck, which can enhance financial security and accelerate wealth accumulation.

Here’s a detailed exploration of what it means to build multiple streams of income, why it’s important, and how you can implement this strategy in your own life.

What Are Multiple Streams of Income?

Multiple streams of income refer to the practice of diversifying your income sources to reduce financial risk and increase overall earnings.

Rather than relying solely on one job or business, individuals with multiple income streams create various avenues to generate money. These streams can include:

- Earned Income: This is the money you make from your primary job or profession.

- Investment Income: Earnings generated from investments, such as dividends from stocks, interest from bonds, or rental income from real estate.

- Passive Income: Income that requires little to no effort to maintain, such as royalties from books, affiliate marketing, or income from online courses.

- Side Hustles: Additional work or businesses that you engage in outside your primary job, such as freelancing, consulting, or selling products online.

Why Is It Important to Build Multiple Income Streams?

1. Financial Security: Relying on a single source of income can be risky. Job loss, economic downturns, or unexpected expenses can create financial instability. Multiple income streams provide a safety net, ensuring that you have alternative sources of revenue.

2. Accelerated Wealth Building: Having various income sources allows you to accumulate wealth faster. The more money you earn, the more you can save and invest, leading to exponential growth over time.

3. Increased Flexibility: Multiple income streams can provide greater flexibility in your lifestyle. They may allow you to pursue passions, travel, or retire earlier, as you aren’t solely dependent on a traditional paycheck.

4. Diversification of Risk: Different income streams can help mitigate risks associated with economic fluctuations. For example, if your primary job is affected by market changes, rental income or investment returns can help maintain your financial stability.

5. Personal Growth and Skill Development: Pursuing side hustles or investments often requires learning new skills, which can enhance your employability and personal development.

How to Build Multiple Streams of Income

1. Assess Your Skills and Interests: Identify your strengths, skills, and interests. Understanding what you enjoy and excel at can help you find viable income opportunities that align with your passions.

2. Start with Your Primary Income: Ensure you have a stable source of income before exploring additional streams. Focus on excelling in your job or business to establish a strong financial foundation.

3. Invest in Assets: Consider investing in assets that can generate income, such as stocks, bonds, or real estate. These investments can provide dividends, interest, or rental income, contributing to your financial growth.

4. Explore Side Hustles: Identify opportunities for side work that fit your schedule and skills. This could include freelance writing, graphic design, tutoring, or creating an online store. Platforms like Upwork or Etsy can help you get started.

5. Create Passive Income Streams: Look for ways to earn money passively. This might involve creating an online course, writing a book, or starting a blog with affiliate marketing. While these may require initial effort, they can generate ongoing income with minimal maintenance.

6. Network and Collaborate: Connect with others in your field or those with complementary skills. Collaborations can lead to new business opportunities, partnerships, or joint ventures that expand your income potential.

7. Reinvest Earnings: As you start generating additional income, consider reinvesting a portion of those earnings into growing your income streams. This could mean buying more rental properties, investing in stocks, or expanding your side business.

Real-Life Example:

Consider the story of a successful entrepreneur who started as a software engineer.

While earning a comfortable salary, he began freelancing on the side, developing websites for local businesses. As his side hustle grew, he hired a team to help scale the business.

Simultaneously, he started investing in real estate, purchasing rental properties that provided consistent income.

He also created an online course teaching software development, which generated passive income through course sales.

By diversifying his income sources, he not only increased his earnings but also gained the freedom to leave his corporate job and focus on his ventures.

Types of Income Streams:

- Active Income: Money earned from direct involvement in work or services.

- Examples: Salaries, wages, freelance work.

- Passive Income: Money earned with minimal ongoing effort.

- Examples: Rental income, dividends, royalties.

- Portfolio Income: Earnings from investments, including stocks and bonds.

- Examples: Capital gains, interest earned on savings, or bonds.

Examples of Extra Income Streams:

- Investing in dividend-paying stocks.

- Starting a side business or freelance gig.

- Monetizing hobbies like photography or blogging.

Building multiple streams of income is a powerful strategy for achieving financial freedom and stability.

By diversifying your income sources, you can reduce risk, accelerate wealth accumulation, and create a more secure financial future.

Start by assessing your skills, exploring side hustles, and investing wisely. Remember, the journey to financial independence is a marathon, not a sprint.

8. They Network Strategically:

Networking isn’t just about meeting people; it’s about building meaningful relationships. Millionaires often surround themselves with individuals who share their drive and vision.

Networking is often viewed as a vital tool for career advancement, but for millionaires, it serves as a strategic asset that can significantly enhance their financial success and opportunities.

Strategic networking goes beyond simple socializing; it involves building meaningful relationships that can lead to collaborations, insights, and opportunities.

Here’s a comprehensive exploration of what it means to network strategically, why it matters, and how you can implement effective networking practices in your own life.

Strategic networking involves cultivating relationships that are aligned with your professional and personal goals.

This process is intentional and focused on building connections that can provide mutual benefits. Unlike casual networking, which may occur at events or social gatherings, strategic networking is about:

- Identifying Key Contacts: Recognizing individuals who can help you achieve your objectives, whether they are mentors, industry leaders, or peers in your field.

- Building Genuine Relationships: Fostering trust and rapport with others through meaningful interactions rather than superficial exchanges.

- Leveraging Connections: Using your network to gain insights, share resources, and create opportunities for collaboration.

Why Is Strategic Networking Important?

- Access to Opportunities: Networking opens doors to job offers, partnerships, investments, and collaborations. Many millionaires attribute their success to the opportunities that arose from their networks.

- Knowledge Sharing: Engaging with a diverse group of individuals allows you to gain insights, learn from others’ experiences, and stay updated on industry trends and best practices.

- Support System: A strong network can provide emotional and professional support. Having a circle of trusted contacts can help you navigate challenges and celebrate successes.

- Increased Visibility: Strategic networking enhances your presence in your industry or community. This visibility can lead to speaking engagements, invitations to exclusive events, and recognition as an expert in your field.

- Mutual Benefit: Successful networking is reciprocal. By helping others in your network, you build goodwill and increase the likelihood that they will assist you in return.

How to Network Strategically:

1. Define Your Goals: Before you begin networking, clarify what you want to achieve. Whether it’s finding a mentor, seeking investment opportunities, or expanding your business, having clear goals will guide your networking efforts.

2. Identify Key Contacts: Research individuals and organizations within your industry or area of interest. Use platforms like LinkedIn to find potential connections who align with your goals.

3. Attend Industry Events: Participate in conferences, seminars, workshops, and networking events relevant to your field. These gatherings provide excellent opportunities to meet influential people and expand your network.

4. Utilize Social Media: Platforms like LinkedIn, Twitter, and industry-specific forums can help you connect with professionals. Engage with their content, join discussions, and share valuable insights to build relationships online.

5. Follow-Up: After meeting someone, send a follow-up message expressing appreciation for the conversation and reiterating your interest in staying connected. This reinforces the relationship and keeps you on their radar.

6. Offer Value: Be proactive in helping your connections. Share resources, make introductions, or provide insights that may benefit them. This establishes you as a valuable contact and encourages reciprocity.

7. Join Professional Associations: Becoming a member of relevant organizations can provide networking opportunities, access to resources, and platforms for collaboration with like-minded individuals.

8. Participate in Community Service: Engaging in volunteer work or community initiatives can help you meet people while contributing to a cause. This can lead to meaningful connections built on shared values.

9. Attend Workshops and Masterminds: Participate in small group workshops or mastermind sessions where you can connect deeply with other professionals and share knowledge and experiences.

10. Maintain Relationships: Networking is not a one-time effort. Regularly check in with your contacts, share updates, and engage with their content to keep the relationship alive.

Real-Life Example:

Consider the story of Sara Blakely, the founder of Spanx. Blakely built her company from the ground up, and a significant part of her success came from strategic networking.

She made connections with influential people in the fashion industry and sought advice from mentors. By attending events and reaching out to individuals who could provide guidance, she was able to secure her first retail deal with Neiman Marcus.

Blakely’s commitment to networking not only opened doors for her brand but also allowed her to learn from others’ experiences, ultimately contributing to her success as a billionaire entrepreneur.

Tools and Platforms for Strategic Networking:

- LinkedIn: A powerful platform for professional networking. Use it to connect with industry peers, join relevant groups, and share insights.

- Meetup: A platform for finding local events and groups based on your interests, allowing you to connect with like-minded individuals.

- Eventbrite: A resource for discovering workshops, seminars, and networking events in your area.

- Professional Associations: Organizations that cater to specific industries or professions, offering networking opportunities and resources.

Networking Tips:

- Attend industry events and conferences.

- Join online communities or local groups focused on wealth-building.

- Seek mentorship from experienced professionals.

“Your network is your net worth.” – Porter Gale

Strategic networking is a vital habit that can significantly influence your career and financial success.

By building genuine relationships, seeking out opportunities, and offering value to your connections, you can create a robust network that supports your aspirations.

9. They Maintain a Healthy Work-Life Balance:

Wealth isn’t just about money; it’s also about time and well-being. Millionaires recognize the importance of physical and mental health in sustaining their success.

Maintaining a healthy work-life balance is essential for long-term success and well-being, and it is a cornerstone habit for many millionaires.

While the drive for financial success can often lead to long hours and relentless work schedules, many successful individuals understand that a balanced life contributes to sustained productivity, creativity, and overall happiness.

Here’s a detailed exploration of what it means to maintain a healthy work-life balance, why it’s important, and how you can achieve it in your own life.

What Does Work-Life Balance Mean?

Work-life balance refers to the equilibrium between personal life and professional responsibilities.

It involves managing your time and energy effectively to ensure that you can fulfill your work obligations while also enjoying personal activities, relationships, and self-care.

A healthy work-life balance allows individuals to thrive both professionally and personally.

Why Is Work-Life Balance Important?

- Enhanced Productivity: Striking a balance between work and personal life can lead to increased productivity. When individuals take breaks and engage in personal activities, they often return to work refreshed and more efficient.

- Reduced Stress: Chronic work-related stress can lead to burnout, anxiety, and health issues. A balanced approach helps mitigate stress by allowing time for relaxation and leisure activities.

- Improved Health: Maintaining a healthy work-life balance encourages individuals to prioritize physical and mental health. This can include regular exercise, healthy eating, and sufficient sleep—essential components of overall well-being.

- Stronger Relationships: Spending quality time with family and friends enhances personal relationships. A balanced life allows individuals to nurture these connections, which can provide emotional support and fulfillment.

- Increased Job Satisfaction: Employees who feel they have a balanced life are often more satisfied with their jobs. This satisfaction can lead to higher retention rates and a more positive workplace culture.

- Greater Creativity and Innovation: Taking time away from work can foster creativity. Engaging in hobbies, travel, or simply relaxing can lead to fresh ideas and perspectives that enhance problem-solving skills.

How to Maintain a Healthy Work-Life Balance:

1. Set Clear Boundaries: Establish specific work hours and communicate them to colleagues and family. Avoid taking work calls or checking emails outside of those hours to create a clear separation between work and personal life.

2. Prioritize Time Management: Utilize tools like calendars and task management apps to organize your schedule. Prioritize tasks based on urgency and importance, and allocate time for both work and personal activities.

3. Learn to Say No: Recognize your limits and avoid overcommitting yourself. Saying no to additional projects or social obligations when you’re already stretched thin is crucial for maintaining balance.

4. Schedule Personal Time: Just as you would schedule meetings, set aside time for personal activities. Whether it’s exercise, hobbies, or family time, treating personal time as a priority is essential for balance.

5. Practice Self-Care: Incorporate self-care activities into your routine. This includes exercise, meditation, reading, or any activity that helps you recharge and relax.

6. Utilize Technology Wisely: Use technology to enhance your work-life balance, such as automation tools to streamline tasks or apps that promote mindfulness and relaxation.

7. Create a Supportive Work Environment: If you’re in a leadership position, foster a culture that values work-life balance. Encourage team members to take breaks, respect personal time, and support each other’s well-being.

8. Reflect and Adjust: Regularly assess your work-life balance. Are you feeling overwhelmed or dissatisfied? Make necessary adjustments to your schedule or commitments to improve your situation.

9. Engage in Hobbies: Pursue interests outside of work that bring you joy and fulfillment. Engaging in hobbies can provide a much-needed break from work-related stress.

10. Seek Professional Help if Needed: If you struggle with maintaining balance, consider speaking with a therapist or counselor. Professional guidance can provide strategies to manage stress and improve your overall well-being.

Real-Life Example:

Consider the example of Richard Branson, the founder of the Virgin Group. Branson is known for his emphasis on work-life balance. He often talks about the importance of taking time off to recharge and spend with family.

Branson has built a company culture that values flexibility, encouraging employees to prioritize their well-being alongside their work responsibilities.

His approach demonstrates that a balanced life not only enhances personal happiness but can also drive innovation and success within a business.

Benefits of a Healthy Work-Life Balance:

- Increased Resilience: A balanced lifestyle helps individuals cope better with stress and adversity, leading to greater resilience in facing challenges.

- Long-Term Career Success: Maintaining balance can lead to sustainable career growth rather than burnout, helping individuals achieve long-term success in their fields.

- Enhanced Quality of Life: Ultimately, a healthy work-life balance contributes to a more fulfilling and satisfying life, allowing individuals to pursue their passions, relationships, and personal goals.

How to Prioritize Balance:

- Schedule regular breaks and vacations.

- Practice mindfulness or meditation.

- Invest in your health with proper diet, exercise, and sleep.

Maintaining a healthy work-life balance is a crucial habit for achieving lasting success and happiness.

By setting boundaries, prioritizing time management, and incorporating self-care into your routine, you can foster an environment that promotes both professional growth and personal fulfillment.

10. They Give Back:

Many millionaires attribute their success to a mindset of abundance and gratitude. Philanthropy not only helps others but also fosters a sense of purpose and fulfillment.

Giving back is a defining trait of many millionaires and successful individuals. This habit goes beyond mere philanthropy; it encompasses a commitment to making a positive impact on society, supporting communities, and fostering change.

Giving back involves contributing time, resources, or expertise to improve the lives of others and strengthen communities. This can take various forms, including:

- Philanthropy: Donating money to charitable organizations, foundations, or causes that align with personal values.

- Volunteering: Offering time and skills to support local charities, non-profits, or community projects.

- Mentorship: Sharing knowledge and experiences to guide and support others, particularly young professionals or those in need.

- Investing in Community Development: Supporting projects that enhance the quality of life in local communities, such as education, healthcare, or infrastructure initiatives.

Why Is Giving Back Important?

- Creating Positive Change: Philanthropy and community service have the power to address pressing social issues, such as poverty, education, and healthcare. Millionaires can leverage their resources to create meaningful change.

- Building a Legacy: Many successful individuals view giving back as a way to leave a lasting impact. Contributing to causes they are passionate about helps establish a legacy that can inspire future generations.

- Fostering Community Ties: Giving back strengthens connections within communities. It promotes a sense of belonging and solidarity, encouraging individuals to work together for common goals.

- Enhancing Personal Fulfillment: Engaging in charitable activities can lead to a sense of purpose and fulfillment. Many millionaires find that giving back enriches their lives and brings joy beyond financial success.

- Networking Opportunities: Philanthropic efforts often provide opportunities to connect with like-minded individuals. Networking within charitable circles can lead to new partnerships and collaborations.

- Inspiring Others: When millionaires give back, they set an example for others. Their actions can inspire friends, family, and colleagues to engage in philanthropy and community service.

How to Incorporate Giving Back into Your Life:

1. Identify Your Passions: Consider the causes or issues that resonate with you. Whether it’s education, health, the environment, or social justice, identifying your passions can guide your giving efforts.

2. Research Organizations: Look for reputable charities or non-profits that align with your interests. Ensure they have a track record of effective programs and transparency in their operations.

3. Volunteer Your Time: Find local organizations that need volunteers. Offer your skills, whether it’s tutoring students, serving meals at a shelter, or helping with community events.

4. Donate Financially: If you have the means, consider making regular financial contributions to charities. This can be a one-time donation or a recurring commitment, such as monthly or annual giving.

5. Share Your Expertise: Offer to mentor or coach individuals in your field. Sharing your knowledge and experiences can have a profound impact on someone’s career or personal development.

6. Engage in Community Projects: Participate in or initiate community development projects. This could involve organizing clean-up events, fundraising for local schools, or supporting local businesses.

7. Create a Giving Strategy: Consider formalizing your giving efforts by creating a charitable giving plan. This can include setting aside a portion of your income for donations or establishing a family foundation.

8. Get Family Involved: Encourage your family to participate in giving back. Engage in family volunteer projects or discuss causes that are important to each family member.

9. Use Social Media for Good: Leverage your online presence to raise awareness about causes you care about. Share information, promote fundraising campaigns, or encourage others to get involved.

10. Evaluate Impact: Regularly assess the impact of your giving efforts. Understanding the outcomes of your contributions can help you refine your approach and maximize your positive influence.

Real-Life Example:

Consider the story of Oprah Winfrey, a billionaire media mogul known for her philanthropic efforts.

Winfrey has contributed millions to various causes, including education, healthcare, and empowerment initiatives for women and children.

Her foundation, the Oprah Winfrey Foundation, supports education and leadership programs, helping to uplift communities.

Winfrey’s commitment to giving back not only reflects her values but also serves as an inspiration to countless individuals.

Her efforts demonstrate how philanthropy can create lasting change and inspire others to engage in similar pursuits.

Benefits of Giving Back:

- Strengthened Communities: Philanthropic efforts contribute to the development of strong, vibrant communities where individuals support one another.

- Personal Growth: Engaging in charitable activities can lead to personal growth, increased empathy, and a broader understanding of societal issues.

- Increased Happiness: Research has shown that giving back can enhance overall happiness and life satisfaction, creating a sense of fulfillment that transcends material wealth.

- Networking and Collaboration: Philanthropy opens doors to connect with other like-minded individuals and organizations, fostering collaboration for greater impact.

How You Can Give Back:

- Volunteer your time or skills to a cause you care about.

- Donate a portion of your income to charity.

- Support local businesses and communities.

“We make a living by what we get, but we make a life by what we give.” – Winston Churchill

Giving back is a powerful habit that enriches both the giver and the community. For millionaires, this commitment to philanthropy and service is often an integral part of their identity and legacy.

By identifying your passions, engaging in charitable activities, and making a positive impact, you can embrace the value of giving back in your own life.

Conclusion: The Top 10 Financial Habits of Millionaires:

The financial habits of millionaires are not reserved for the elite; they are accessible to anyone willing to adopt them.

By living below your means, investing wisely, and continuously learning, you can pave the way to financial success.

Becoming a millionaire isn’t an overnight process; it’s a journey that requires discipline, patience, and smart financial habits.

By adopting these habits today, you’ll not only improve your financial health but also set the foundation for a prosperous future.

Remember, “The best time to plant a tree was 20 years ago. The second-best time is now.” Start small, stay consistent, and watch your wealth grow.

Take Action Today!

- List three financial habits you’ll start this week.

- Share this article with someone who could benefit from it.

- Join the conversation on social media using #MillionaireMindset #FinancialFreedom

Let’s build a better financial future together! 🚀

Recommended Personal Finance Books

1. “The Total Money Makeover” by Dave Ramsey

A practical guide to eliminating debt and building wealth using a step-by-step approach.

Book Buy Link: Amazon Click Here

2. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book provides a holistic approach to achieving financial independence and aligning spending with your values.

3. “Rich Dad Poor Dad” by Robert T. Kiyosaki

A classic that contrasts different mindsets about money and introduces concepts like assets and liabilities.

4. “The Psychology of Money” by Morgan Housel

An insightful read on how emotions and behavior affect financial decisions.

5. “Atomic Habits” by James Clear

While not strictly about finance, this book teaches you how to build habits that can also improve your financial discipline.

6. “I Will Teach You to Be Rich” by Ramit Sethi

A fun, practical guide to managing money, including automation and optimizing spending without guilt.

7. “Financial Freedom” by Grant Sabatier

A step-by-step blueprint to achieving financial independence faster than traditional methods.

Other Interesting Posts To Read:

The 10 Commandments of Long-Term Investing Success

10 Smart Investment Strategies for First-Time Investors

10 Stoic Habits That Can Help & Guide You Toward Financial Independence 🏦

10 Financial Freedom Lessons Men Learn Too Late In Life

5 Smart Budgeting Hacks to Save Big in 2025