Discover the top 10 passive income streams to start in 2025! Learn how to build financial freedom with minimal effort. #PassiveIncome #FinancialFreedom”

In today’s fast-paced world, earning money while you sleep is more appealing than ever. Passive income streams provide a way to build wealth without the constant grind of a traditional job.

Creating passive income can be a game-changer if you’re looking to supplement your income or achieve financial freedom.

In this article, we’ll explore the top 10 passive income streams you can start today, complete with tips, strategies, and real-world examples to inspire you.

What is Passive Income?

Before diving into the specifics, let’s clarify what passive income means. Passive income is money earned with minimal effort or active involvement.

Unlike active income, which requires you to trade time for money, passive income allows you to generate revenue from investments, side projects, or other income-producing activities.

Why Consider Passive Income?

- Financial Independence: Create a safety net that can support you during tough times.

- Time Freedom: Free up your time to pursue hobbies, travel, or spend time with family.

- Wealth Building: Invest in opportunities that grow over time.

As Robert Kiyosaki, author of Rich Dad Poor Dad, states, “The more a person seeks security, the more that person gives up control over their life.”

1. Real Estate Investing

Real estate is a classic way to generate passive income. By purchasing rental properties, you can earn monthly rental income and benefit from property appreciation over time.

Getting Started:

- Research Markets: Look for areas with high rental demand and low vacancy rates.

- Financing Options: Consider traditional mortgages, hard money loans, or partnerships.

- Property Management: Hire a property manager to handle day-to-day operations.

“Investing in real estate is not just about owning property; it’s about creating a lifestyle.” — Unknown

2. Investing in Dividend Stocks

Dividend stocks are shares of companies that distribute a portion of their earnings to shareholders regularly.

By investing in reliable dividend-paying stocks, you can enjoy steady income while potentially benefiting from capital appreciation.

How to Get Started:

- Choose Reliable Companies: Look for companies with a history of consistent dividend payments.

- Diversify Your Portfolio: Invest in different sectors to mitigate risk.

- Reinvest Dividends: Use dividend reinvestment plans (DRIPs) to purchase more shares.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

3. Investing in Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect investors with borrowers. By lending money, you earn interest on your investment over time.

Getting Started:

- Choose a Platform: Research reputable P2P lending platforms like LendingClub or Prosper.

- Assess Risk: Diversify your loans across multiple borrowers to minimize risk.

- Monitor Your Investments: Keep an eye on your loan performance and returns.

“The best way to predict the future is to create it.” — Peter Drucker

Recommended Platforms:

- LendingClub

- Prosper

- Upstart

Why Try It?

It’s an excellent way to diversify your portfolio while earning returns higher than traditional savings accounts.

4. Creating and Selling Online Courses

If you have expertise in a subject, you can monetize it by creating online courses. Platforms like Udemy, Teachable, or Skillshare make it easy to share your knowledge with the world.

Steps to Start:

- Identify Your Niche: Focus on subjects you are passionate about and have knowledge in.

- Create Quality Content: Invest time in creating engaging and informative course materials.

- Market Your Course: Utilize social media and email marketing to reach potential students.

“Education is the most powerful weapon which you can use to change the world.” — Nelson Mandela

5. Affiliate Marketing

Affiliate marketing allows you to earn a commission by promoting other people’s products or services.

By sharing your unique affiliate link, you can earn money whenever someone purchases through your link.

Getting Started:

- Choose Your Niche: Focus on a niche that aligns with your interests and expertise.

- Join Affiliate Programs: Sign up for programs like Amazon Associates or ShareASale.

- Create Quality Content: Write blog posts, and reviews, or create videos that promote the products.

“The best marketing doesn’t feel like marketing.” — Tom Fishburne

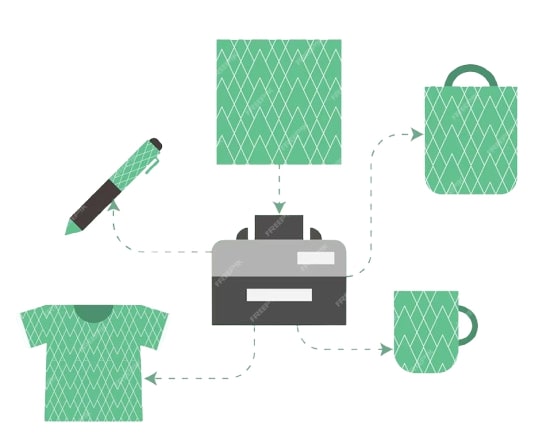

6. Print-on-Demand Products

Print-on-demand (POD) services allow you to design custom products like t-shirts, mugs, and posters.

When customers place orders, the platform handles printing and shipping, leaving you to focus on creativity.

Popular POD Platforms:

- Printful

- Redbubble

- Teespring

Why It Works:

You earn a profit margin on each sale without needing inventory. Plus, it’s a great way to turn your artistic flair into passive income.

“Opportunities don’t happen. You create them.” – Chris Grosser

7. Write a Book or E-book

If you have a story to tell or expertise to share, writing a book can provide a long-lasting source of passive income. Once published, your book can continue to sell for years.

Getting Started:

- Choose a Topic: Write about something you are passionate about or knowledgeable about.

- Self-Publishing: Consider platforms like Amazon Kindle Direct Publishing for easy access to a vast audience.

- Market Your Book: Utilize social media and book promotion sites to boost visibility.

“There is no greater agony than bearing an untold story inside you.” — Maya Angelou

8. Create a YouTube Channel

YouTube offers a platform to share your creativity and expertise while earning passive income through ad revenue.

With engaging content, your channel can become a source of income over time.

Getting Started:

- Choose Your Niche: Focus on topics you are passionate about.

- Create Quality Videos: Invest in good equipment and editing software.

- Monetize Your Channel: Once you meet the requirements, apply for the YouTube Partner Program.

YouTube is a platform that allows you to be yourself and share your passions.

9. Building a Niche Blog

Blogging isn’t dead; it’s thriving. By starting a blog on a specific niche, you can earn through ads, sponsorships, and affiliate marketing.

Steps to Launch:

- Choose a profitable niche (e.g., travel, personal finance, health).

- Create a content plan and publish consistently.

- Optimize for SEO to drive organic traffic.

“Content is king.” – Bill Gates

10. Mobile Apps and Websites

If you have programming skills, consider creating a mobile app or website. With the right idea and execution, your app or site can generate passive income through ads, subscriptions, or sales.

Getting Started:

- Identify a Need: Research market trends to find a gap in the market.

- Develop Your Idea: Create a prototype and gather feedback.

- Monetize Your App: Use ads, in-app purchases, or subscriptions to generate income.

Tools to Use:

- Flutter

- Unity

- React Native

Example Success:

Flappy Bird became a global sensation and earned its developer thousands in daily ad revenue. Your best shot at creating a successful app is to simply create it.

Final Thoughts on Top 10 Passive Income Streams You Can Start in 2025

Creating passive income streams is a journey that requires initial effort and investment, but the long-term benefits can be life-changing.

By diversifying your income sources and exploring different avenues, you can achieve financial freedom and enjoy the lifestyle you desire.

Remember, “The best time to plant a tree was 20 years ago. The second best time is now.” — Chinese Proverb. Start your passive income journey today!

The goal is to create multiple income streams to achieve financial freedom. Which passive income stream resonates with you the most?

Share your thoughts in the comments below and let’s inspire each other on this journey towards financial independence!

#FinancialFreedom #PassiveIncome

Other Interesting Posts To Read:

From Zero to Hero: How to Build Wealth Starting from Scratch

10 Smart Investment Strategies for First-Time Investors

10 Stoic Habits That Can Help & Guide You Toward Financial Independence 🏦

10 Financial Freedom Lessons Men Learn Too Late In Life

5 Smart Budgeting Hacks to Save Big in 2025

Recommended Personal Finance Books

1. “The Total Money Makeover” by Dave Ramsey

A practical guide to eliminating debt and building wealth using a step-by-step approach.

Book Buy Link: Amazon Click Here

2. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book provides a holistic approach to achieving financial independence and aligning spending with your values.

3. “Rich Dad Poor Dad” by Robert T. Kiyosaki

A classic that contrasts different mindsets about money and introduces concepts like assets and liabilities.

4. “The Psychology of Money” by Morgan Housel

An insightful read on how emotions and behavior affect financial decisions.

5. “Atomic Habits” by James Clear

While not strictly about finance, this book teaches you how to build habits that can also improve your financial discipline.

6. “I Will Teach You to Be Rich” by Ramit Sethi

A fun, practical guide to managing money, including automation and optimizing spending without guilt.

7. “Financial Freedom” by Grant Sabatier

A step-by-step blueprint to achieving financial independence faster than traditional methods.

[…] Top 10 Passive Income Streams You Can Start in 2025 […]

[…] Top 10 Passive Income Streams You Can Start in 2025 […]

[…] Top 10 Passive Income Streams You Can Start in 2025 […]